Lowe’s Companies (LOW) recently reported earnings for its second quarter of Fiscal Year 2022. Adjusted earnings per share came in at $4.67, which beat analysts’ consensus estimate of $4.58 per Lowe’s share. As a result, the stock is up roughly 3% as of this writing. In the past nine quarters, the company has beat estimates eight times.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

On the other hand, sales decreased 0.36% year-over-year, with revenue hitting $27.5 billion compared to $27.6 billion. The decrease in sales can be attributed to a shorter spring and lower demand for certain discretionary items that impacted DIY sales.

However, gross profits decreased by 1.9%, which means that the company saw operating deleverage since it decreased more than revenue. Indeed, the gross margin contracted from 33.78% to 33.24%.

Nevertheless, Lowe’s implemented cost control measures that allowed it to increase operating income from $4.21 billion in the comparable period to $4.23 billion now. The lower operating costs, along with the significant reduction in shares outstanding due to buybacks, resulted in the higher-than-expected EPS result.

Investor Sentiment is Positive for LOW Stock

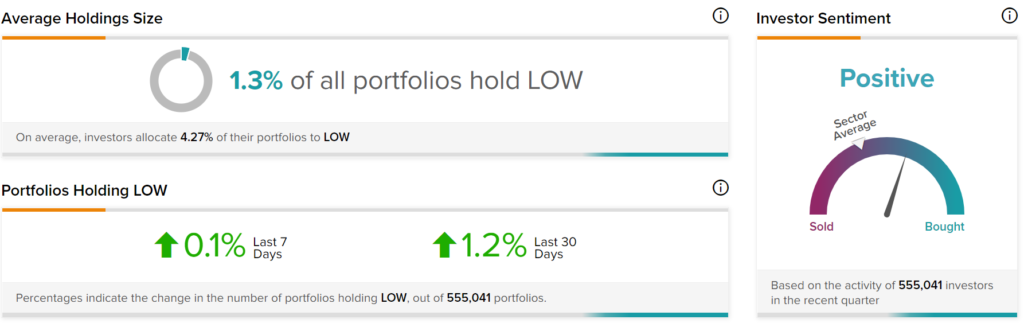

The sentiment among TipRanks investors is currently positive. Out of the 555,041 portfolios tracked by TipRanks, 1.3% hold LOW. In addition, the average portfolio weighting allocated towards LOW among those who do have a position is 4.27%. This suggests that investors of the company are quite confident about its future.

In addition, in the last 30 days, 1.2% of those holding the stock increased their positions. As a result, the stock’s sentiment is above the sector average, as demonstrated in the following image:

Is Lowes Stock a Buy or Sell?

LOW has a Moderate Buy consensus rating based on 14 Buys, six Holds, and zero Sells assigned in the past three months. The average LOW price target of $228.61 implies 5.4% upside potential.

Takeaway – Lowe’s is Run by an Effective Management Team

The Lowe’s management team has demonstrated it is very effective at running the company. Despite the increase in sales, management was able to increase shareholder value on an EPS basis by reducing unnecessary costs and returning excess capital to shareholders through share buybacks. Thus, it’s easy to see why investor sentiment is positive for the stock.