Bernstein analyst Zhihan Ma weighed in on the two U.S. home improvement giants, Lowe’s (LOW) and Home Depot (HD). The analyst raised the Lowe’s price target to $282 (from $279) while keeping a Buy rating, and lifted Home Depot’s target to $406 (from $403) with a Neutral rating.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Ma continues to favor Lowe’s over Home Depot in the near to medium term, pointing to its cheaper valuation and stronger recovery potential once housing activity picks up.

Why Bernstein Prefers Lowe’s over HD

Ma said that Lowe’s is trading near an all-time high valuation discount to Home Depot, offering better relative upside. He expects Lowe’s to narrow its margin gap with Home Depot as the company executes on cost-saving initiatives that will likely offset higher investment spending.

He added that in the event of a housing market recovery, Lowe’s could rebound faster, thanks to its greater exposure to “big-ticket, discretionary spending categories.”

Home Depot Remains Steady but Fully Valued

While Bernstein raised the price target on Home Depot to $406, Ma maintained a Neutral rating, suggesting limited upside from current levels.

He said Home Depot needs around 3% comparable sales growth to drive operating leverage and offset rising costs, which may be difficult in the current environment of soft housing demand and persistent inflation.

Still, Ma noted that both Lowe’s and Home Depot are likely to be driven more by macroeconomic factors, such as inflation and interest rates, than by company-specific fundamentals in the near term.

Which Is the Better Home Improvement Stock?

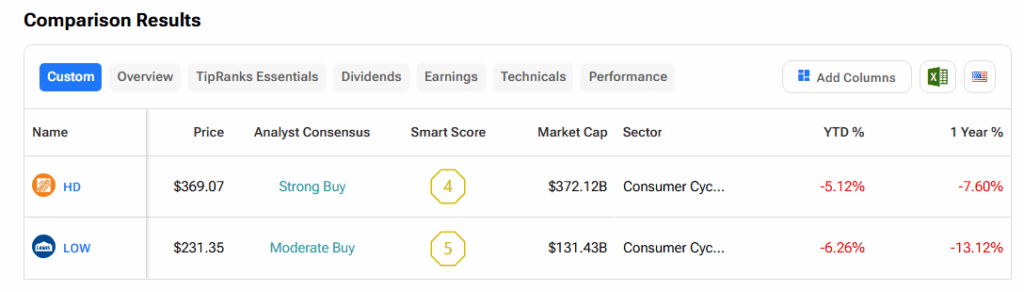

Using TipRanks’ Stock Comparison Tool, we found that Home Depot carries a Strong Buy consensus rating, while Lowe’s holds a Moderate Buy rating from Wall Street analysts.

Both stocks have underperformed this year, with Lowe’s down about 6% year-to-date and Home Depot down roughly 5%.