Lordstown Motors stock (NASDAQ:RIDE) tumbled about 53% in Tuesday’s early trade, wiping off half of its market capitalization. The fall comes after the company filed for Chapter 11 bankruptcy protection earlier today. Simultaneously, RIDE has also filed a lawsuit against Foxconn, a Taiwanese electronics contract manufacturer, accusing the latter of fraudulent conduct that caused significant damage to Lordstown’s operations.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

RIDE, with approximately $500 million in both assets and liabilities, is initiating a sale process to optimize the value of its Endurance electric pickup. Interestingly, the company holds an optimistic outlook regarding the potential for continued progress and success of the Endurance vehicle under new ownership.

Lordstown-Foxconn Dispute

Lordstown Motors has accused Foxconn of failing to meet its promised investment. According to the complaint, Foxconn did not provide the necessary support in the construction of the Endurance pickup truck and future collaborative product development endeavors.

Additionally, RIDE alleges that Foxconn’s intention behind this pretense was to gain control over Lordstown’s key asset, the Ohio manufacturing plant, as well as Lordstown’s skilled employees from the manufacturing and operational teams.

It is worth mentioning that in May, Lordstown issued a warning to investors, stating that the company could potentially be compelled to file for bankruptcy due to the uncertainty over Foxconn’s funding.

What is the Future of RIDE Stock?

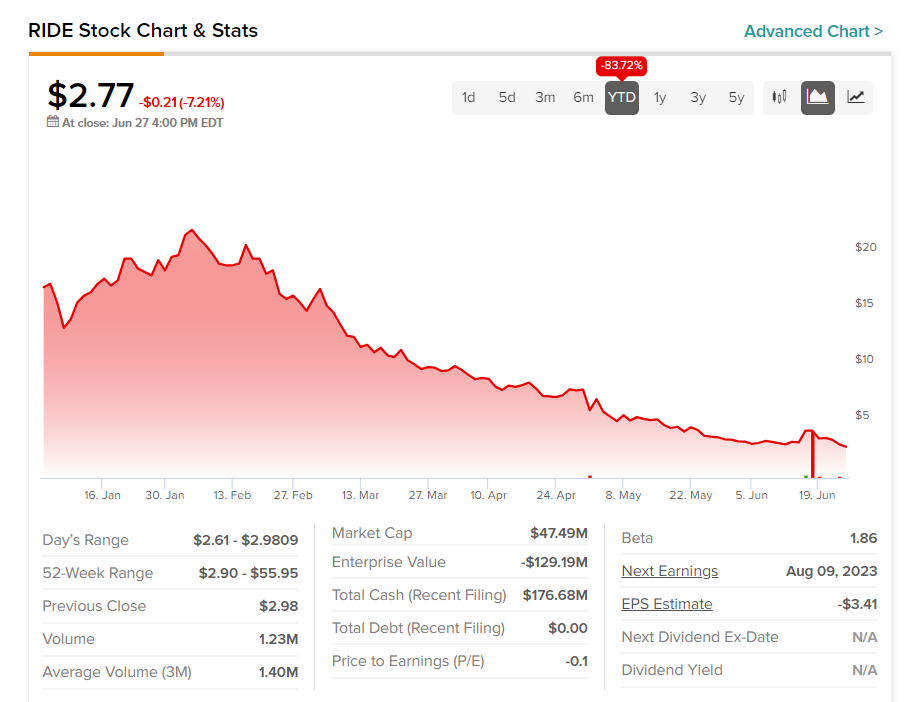

The recent negative response from the market indicates a decline in investor confidence and highlights the challenges and uncertainties that Lordstown Motors faces. Furthermore, the company’s stock performance has been unsatisfactory this year, with the stock experiencing a loss of nearly 84%.

It is noteworthy that the company’s founder and former CEO, Stephen Burns, who resigned in 2021, sold all his stake in RIDE. He divested shares in multiple transactions on May 23, May 24, and June 16. Burns’ actions indicate his lack of belief in the company’s potential for success.