Baidu’s (BIDU) growth prospects are driven by AI expansion, cloud computing, and autonomous driving. The company is investing in Ernie Bot AI and cloud services to strengthen its position in China’s AI sector. Also, it is expanding its Apollo Go robotaxi operations globally. Thus, investors looking for exposure to BIDU stock may consider investing in these two ETFs: Invesco Golden Dragon China ETF (PGJ) and Global X Social Media ETF (SOCL).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It is worth mentioning that Baidu recently beat expectations in Q1, driven by strong growth in AI Cloud and robotaxi expansion. Particularly, AI Cloud revenue surged 42% year-over-year, reflecting rising adoption of Baidu’s full-stack AI solutions.

Let’s take a deeper look at these two ETFs.

Invesco Golden Dragon China ETF

The PGJ ETF focuses on U.S.-listed Chinese companies, offering exposure to China’s technology, consumer, and communication sectors. It tracks the NASDAQ Golden Dragon China Index. Importantly, BIDU accounts for 6.82% of PGJ’s total holdings.

Some of the top holdings in PGJ ETF include Alibaba (BABA), Yum China (YUMC), and JD.com (JD). Overall, the ETF has $148.29 million in assets under management (AUM) and an expense ratio of 0.67%. Over the past year, the PGJ ETF has generated a return of 5.63%.

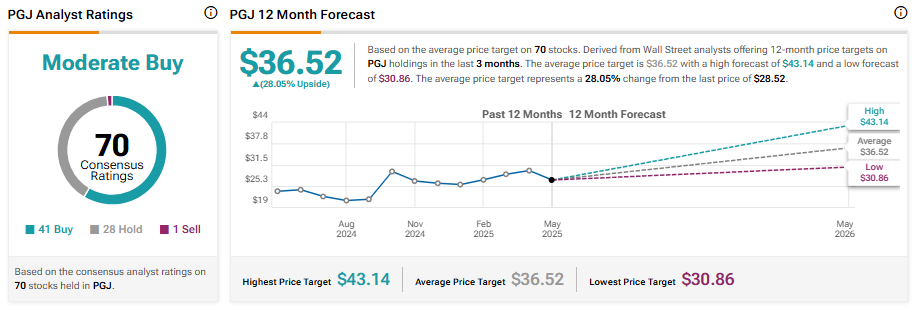

On TipRanks, PGJ has a Moderate Buy consensus rating based on 41 Buys, 28 Holds, and one Sell assigned in the last three months. At $36.52, the average PGJ ETF price target implies 28.05% upside potential.

Global X Social Media ETF

The SOCL ETF provides exposure to social media companies, tracking the Solactive Social Media Total Return Index. It focuses on high-growth social media companies, including established giants and emerging players. BIDU stock constitutes 4.38% of the ETF’s holdings.

Apart from BIDU, some of the top stocks in the SOCL ETF are Meta Platforms (META), Pinterest (PINS), and NetEase (NTES). Overall, the ETF has $121.46 million in AUM. Also, it has an expense ratio of 0.65%. The SOCL ETF has returned 6.83% in the past year.

Turning to Wall Street, the ETF has a Moderate Buy consensus rating. Of the 51 stocks held, 29 have Buys and 22 have a Hold rating. At $54.46, the average SOCL ETF price target implies a 16.9% upside potential.

Concluding Thoughts

ETFs provide indirect exposure to BIDU, reducing risk compared to investing directly in the stock. Furthermore, ETFs are a liquid and transparent way to participate in the market. Investors seeking ETF recommendations might consider PGJ and SOCL, as these ETFs offer exposure to Baidu stock.