Logitech International (NASDAQ: LOGI) slumped more than 15% in pre-market trading on Thursday as the manufacturer of computer peripherals and software company’s preliminary fiscal Q3 results left investors disappointed.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company announced preliminary Q3 net sales in the range of $1.26 billion to $1.27 billion, a year-over-year decline between 22% and 23% and below consensus estimates of $1.39 billion.

Preliminary Q3 adjusted operating income is likely to be in the range of $198 million to $203 million, a year-over-year fall between 33% and 34% while the adjusted operating margin is between 15.7% and 16%.

Bracken Darrell, Logitech’s President, and CEO commented, “Based on the softer than expected third quarter results, and uncertainty in supply availability related to the current Covid outbreak in China, we are reducing our full-year outlook.”

The company has lowered its FY23 outlook and now expects sales to decline year-over-year to between 15% and 13% in constant currency, and adjusted operating income to be in the range of $550 million to $600 million.

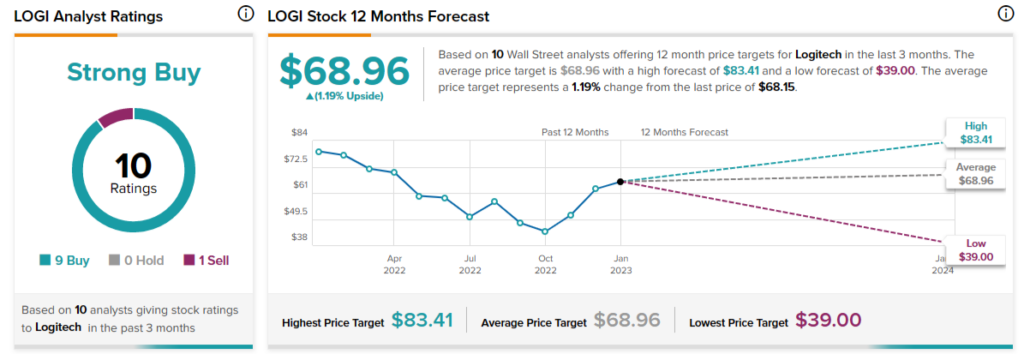

Analysts are bullish about LOGI stock with a Strong Buy consensus rating based on nine Buys and one Sell.