Logitech (NASDAQ:LOGI) shares are climbing higher today after the hardware and software solutions provider announced better-than-anticipated first-quarter numbers. While revenue declined 16% year-over-year to $974 million, the figure still came in ahead of expectations by $56.5 million. EPS at $0.65 too outperformed estimates by $0.19.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Amid a challenging market scenario, Logitech managed to lower inventory levels as well as operating expenses. At the same time, net sales across multiple product categories including Gaming, Keyboards & Combos, Video Collaboration, Webcams, and Headsets saw a double-digit decline.

Tablet Accessories was the lone product category to see an uptick in net sales during the quarter. Nonetheless, the company has raised its expectations for the first half of fiscal 2024 with sales anticipated between $1.875 billion to $1.975 billion (prior outlook between $1.8 billion and $1.9 billion). Operating income is expected between $180 million and $220 million (prior outlook between $160 million and $190 million).

For the full-year 2024, operating income is seen hovering between $400 million and $500 million on revenue between $3.8 billion and $4 billion.

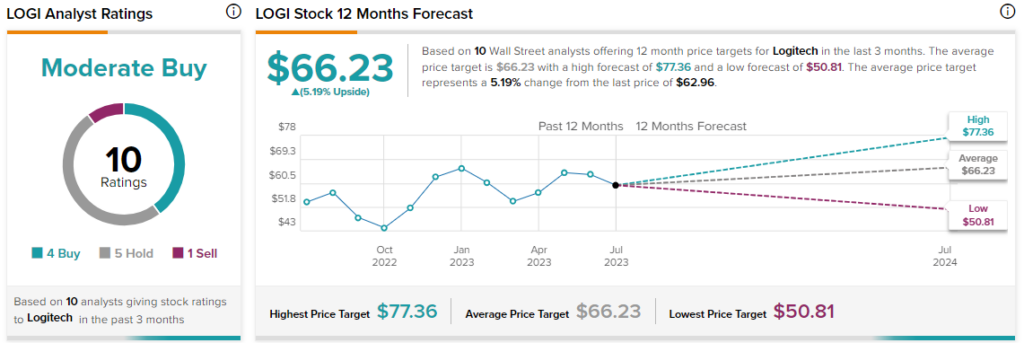

Overall, the Street has a $66.23 consensus price target on Logitech alongside a Moderate Buy consensus rating. Today’s price gains come on top of a 13.2% rise in Logitech shares over the past month alone.

Read full Disclosure