Manufacturer of computer peripherals and software Logitech (NASDAQ:LOGI) slid in pre-market trading after the company announced results for its third quarter of FY24. The company reported adjusted earnings of $1.53 per share, up by 34% year-over-year, and surpassed analysts’ estimates of $1.15 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, the company’s sales declined by 3% year-over-year on a constant currency basis to $1.26 billion. Analysts were expecting sales of $1.25 billion.

Looking forward, Logitech’s management stated that it was going to focus on growing its revenues and raised its FY24 outlook. The company now expects FY24 sales in the range of $4.2 billion to $4.25 billion, compared to its prior guidance of between $4 billion and $4.15 billion. The raised outlook still indicates a year-over-year decline in revenues in the range of 7% to 6%. Logitech has projected adjusted operating income between $610 million and $660 million.

What is the Price Prediction for LOGI?

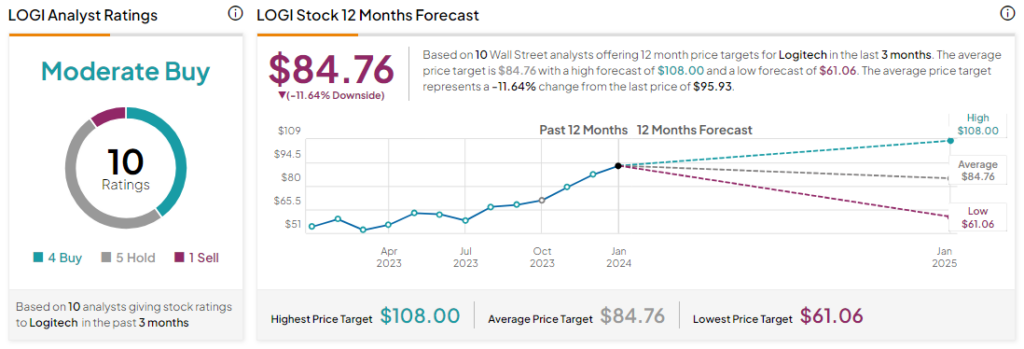

Analysts remain cautiously optimistic about LOGI stock with a Moderate Buy consensus rating based on four Buys, five Holds, and one Sell. Over the past year, LOGI stock has jumped by more than 60%, and the average LOGI price target of $84.76 implies a downside potential of 11.6% at current levels.