Manufacturer of computer peripherals and software, Logitech International (NASDAQ: LOGI) jumped in pre-market trading on Tuesday after the company announced fiscal second quarter results. The company reported adjusted earnings of $1.09 per share, up 30% year-over-year and surpassed consensus estimates of $0.58 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Sales declined by 8% year-over-year to $1.06 billion in Q2 but were above analysts’ expectations of $972.9 million.

Chuck Boynton, Logitech’s CFO, commented, “While our second quarter revenue was down compared to last year, we delivered expanded gross margins of 42.0% and operating margins of 17.3%. Through strong operating execution and working capital management, we generated $223 million in operating cash flow and returned $276 million to our shareholders.”

The company’s management also stated that they were closer to choosing a new CEO for the company after four-month search.

Looking forward, management has also updated its FY24 outlook and expects its sales to be in the range of $4 billion to $4.15 billion as compared to its prior outlook between $3.8 billion and $4 billion. For reference, analysts have forecast revenues of $4.04 billion. FY24 adjusted operating income is estimated to be between $525 million and $575 million.

Will Logitech Stock Go Up?

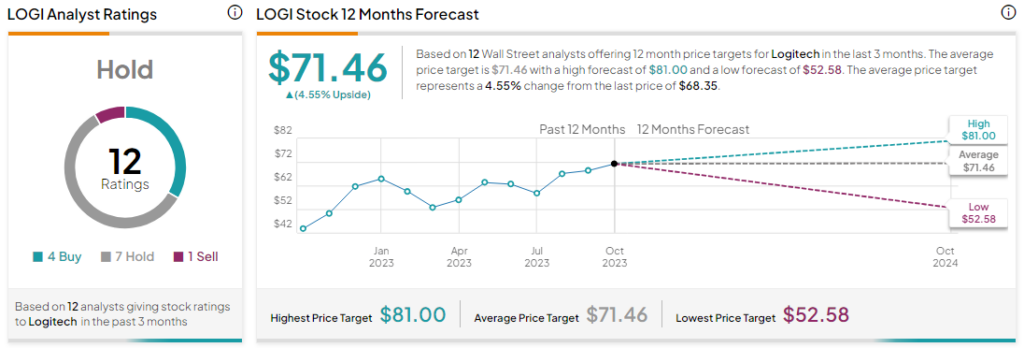

Analysts remain sidelined about LOGI stock with a Hold consensus rating based on four Buys, seven Holds and one Sell. The average LOGI price target of $71.46 implies an upside potential of 4.5% at current levels. The average consensus price target indicates that Logitech still retains upside potential.