Aerospace and defense major Lockheed Martin (NYSE:LMT) was down in trading after its FY24 outlook failed to cheer investors. The company guided for net revenues in the range of $68.5 billion to $70 billion compared to consensus estimates of $68.6 billion. The company also projected earnings of between $25.65 and $26.35 per share, while analysts were expecting earnings of $26.46 per share. The lower-than-expected EPS can be attributed to the company’s labor and supply chain challenges.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company had stated back in October that its production had been adversely impacted by a supply shortage in processor assemblies, solid-rocket motors, castings, and forgings.

In its fourth quarter, Lockheed Martin reported adjusted earnings of $7.90 per share compared to $7.70 per share in the same quarter last year. This was above analysts’ estimates of $7.29 per share. On the other hand, sales declined by 5.26% year-over-year to $18.9 billion but still beat consensus estimates of $17.9 billion. In addition, the company had a record backlog of $160.6 billion at the end of FY23.

Is LMT a Good Stock to Buy?

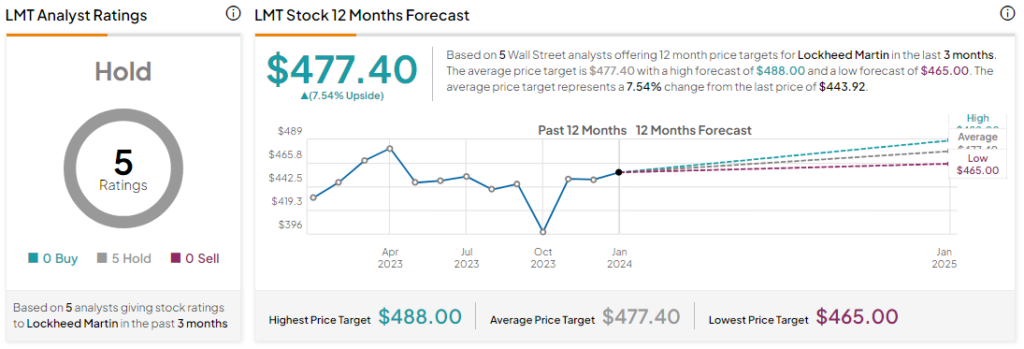

Analysts remain sidelined about LMT stock with a Hold consensus rating based on five Holds. LMT stock has gone up by only 3.3% in the past year, and the average LMT price target of $477.40 implies an upside potential of 7.5% at current levels.