In an era defined by trade protectionism, resurgent nationalism, and escalating conflicts, Lockheed Martin (LMT) finds itself in a uniquely advantageous position. The world’s largest defense contractor isn’t just selling state-of-the-art technology—it’s selling assurance, deterrence, and dominance. And investors are taking notice.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

By year’s end, Lockheed Martin expects to assemble as many as 200 new F-35 fighter jets, priced at ~$80-$100 million each, destined for a growing roster of global buyers who’ve contributed a record $179 billion to LMT’s backlog for future delivery. Speaking at the firm’s Q3 earnings call last month, LMT’s CEO Jim Taiclet said the firm is on track to “manufacture one plane for every working day of the year.”

Two weeks ago, the U.S. aerospace bellwether confirmed record-breaking production momentum for its crown jewel, the F-35 Lightning II — at a time when defense spending is surging worldwide. By the end of Q3, LMT delivered 143 F-35s, already surpassing its previous annual record of 142 set in 2022. With an ambitious target set to be met by year-end, the defense firm could post the strongest delivery year of the decade—a 64% jump over 2023.

According to its proponents, the F-35 program is not just another production line—it’s the largest and most advanced fighter project in history, with over 1,200 jets in service worldwide. Built primarily at Lockheed’s facility in Fort Worth, Texas, the F-35 comes in three variants designed for multiple military branches and allied nations. From the U.S. Navy to Finland’s Air Force, the jet represents a symbol of strength for nations allied to the U.S., with “deterrence” as the prime motive.

But Lockheed’s story isn’t purely about engineering or leading the field with the best research and development—it’s about timing. Amid wars in Ukraine and the Middle East, and as China projects power across the Indo-Pacific, defense budgets have become political statements.

With Donald Trump dominating the global political stage and combining nationalism with industrialism, “Made in America” defense assets, such as the F-35, are once again a strategic currency. LMT is not only a defense contractor selling state-of-the-art aircraft, but it also aligns with national geopolitical objectives and generates intangible value for its managers and shareholders.

Lockheed Martin Overcomes F-35 Delays

It’s worth noting that Lockheed’s delivery streak isn’t without complexity. The company is catching up from last year’s production delays caused by integration issues with its Technology Refresh 3 (TR-3) software and hardware package. Deliveries of “truncated” TR-3 aircraft began mid-2024 after a pause, and about 18% of this year’s deliveries will come from previously built jets that were held in storage.

Those technical challenges cost Lockheed roughly $700 million in revenue shortfall last year and temporarily muted confidence. But the rebound has been emphatic. April 2025 marked the highest single-month delivery total in the program’s history, with 23 F-35s cleared for delivery.

Progress on TR-3 integration and steady increases in output have restored credibility—both within the Pentagon and among investors looking for execution stability in the defense sector.

Record Backlog Translates Into Mushrooming Profits

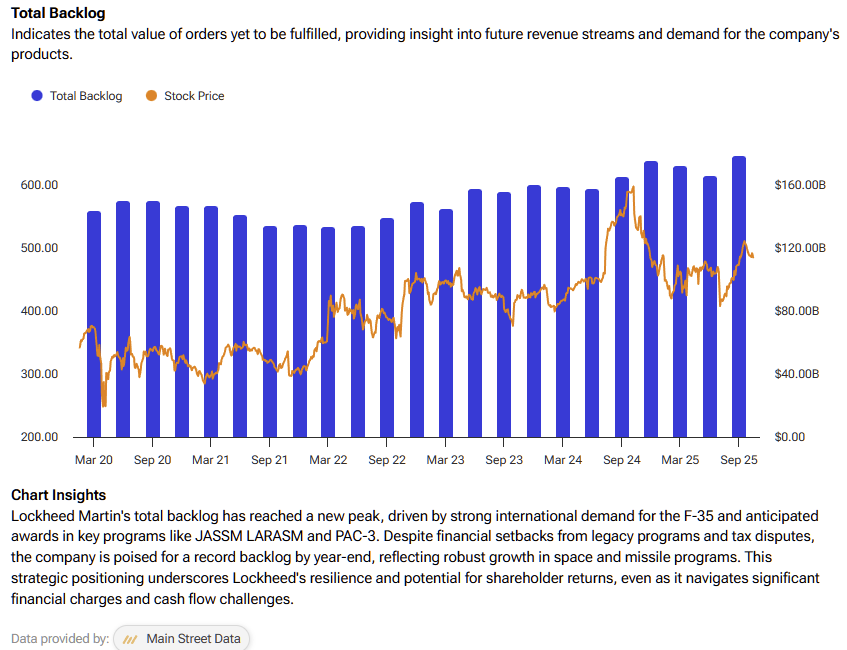

Beyond fighter jets, Lockheed’s fundamentals have rarely looked stronger. The company posted a steady 9% year-over-year increase in sales, while robust margins drove a comparable ~9% rise in gross profit. Its backlog has surged to a record $179 billion, offering investors exceptional visibility into future production and revenue streams.

New multi-year contracts—spanning the PAC-3 missile, JASSM/LRASM long-range systems, and the CH-53K heavy-lift helicopter—total $30 billion. Additionally, the F-35 Lot 18 and 19 contracts added another $11 billion. Aeronautics sales are expected to add a further $4 billion by the end of 2025, with the profit margin on that segment rising by 3%.

The Intangible Premium

At a market level, LMT stock carries something that can’t be easily modeled: intangible value tied to geopolitical sentiment. The company benefits from a rare blend of bipartisan defense support, surging international demand, and a global mood leaning toward protectionism and rearmament.

As protectionism reshapes global supply chains and nationalism drives defense spending, Lockheed Martin’s U.S.-based production ensures its current competitive advantage turns into future market dominance. When looking at all this from a macro perspective, a Trumpian economic policy where industrial revival meets patriotic rhetoric—the biggest beneficiaries are likely to be firms rooted in America’s strategic core: defense, heavy industry, natural resources, and even cryptocurrency, all viewed as pillars of a renewed push to “make America great again.”

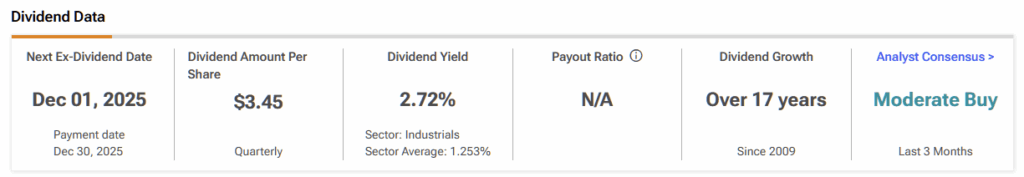

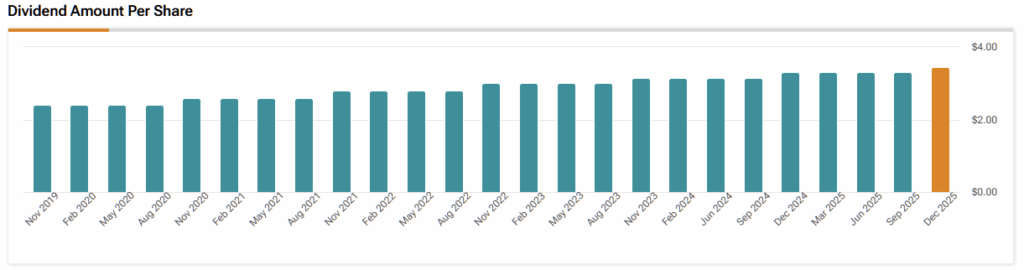

The confluence of positive catalysts also bodes well for LMT shareholders. Not only are external market factors aligning favorably, but stockholders are also being rewarded by handsome dividends. In recent news, Lockheed approved a 5% dividend increase, its 23rd consecutive annual hike, and expanded its share repurchase authorization.

Global Instability Drives Defense Demand

Looking ahead to 2025, Lockheed Martin projects mid-single-digit revenue growth and $6.6 billion in free cash flow. Challenges persist—most notably in supply chain constraints and the slower production ramp of Sikorsky’s CH-53K helicopter—but the overall trajectory remains unmistakably upward.

As global instability fuels defense demand, Lockheed Martin appears to be firmly back on the ascent. For investors seeking reliable exposure to the defense sector, LMT stands not just as a stock, but as a stabilizing force in an uncertain, geopolitically sensitive world.