Earlier today, Loblaw Companies (TSE:L) (OTC:LBLCF) announced its Q1-2023 earnings results, which came in mixed. While earnings per share (EPS) were in line with expectations, revenue missed the mark. As a result, the stock is trending lower today despite Loblaw raising its quarterly dividend by 10% to C$0.446/share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

During Q1, sales reached C$13 billion, a 6% year-over-year increase, missing the C$13.17 billion consensus estimate. Meanwhile, adjusted diluted earnings per share rose by 14% to C$1.55, meeting expectations. Adjusted net earnings experienced a 10% increase, reaching C$505 million, and operating income grew by 4.2% to C$769 million.

Loblaw’s Retail segment saw sales rise by 5.7% to C$12.74 billion, while its adjusted gross margin increased by 20 basis points year-over-year to 31.3%. However, e-commerce sales decreased by 1.1% year-over-year, reflecting the effect of lockdowns in the previous year. Additionally, the company’s retail free cash flow was -C$81 million. Nonetheless, Loblaw still repurchased 3.3 million shares for a total of C$383 million.

Moving on to the Financial Services segment, it demonstrated strong growth, with revenues increasing by 19% to C$326 million, but earnings before income taxes for the segment fell year-over-year from C$32 million to C$12 million.

Full-Year Outlook

For the full year 2023, Loblaw expects its retail business to grow earnings faster than sales, achieve low double-digit growth in adjusted net earnings per common share, invest a net C$1.6 billion in capital expenditures, and allocate a significant portion of free cash flow to share repurchases.

Is Loblaw Stock a Buy, According to Analysts?

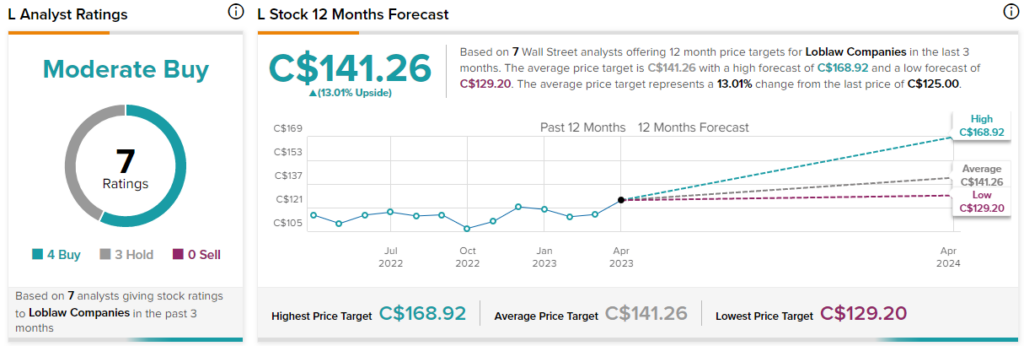

According to analysts, Loblaw stock has a Moderate Buy consensus rating based on four Buys and three Holds assigned in the past three months. The average Loblaw stock price target of C$141.62 implies 13% upside potential. Analyst price targets range from a high of C$168.92 to a low of C$129.20.