The stock market’s “buy low, sell high” maxim is a well-worn cliché, but for good reason. Buying a stock when it’s in the doldrums represents the right play for big returns, but it is easier said than done. After all, there’s a reason why a stock is at a low point, sometimes justifiably so, but not always; that’s when the big opportunity makes itself evident.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Looking at the case of Rivian (NASDAQ:RIVN), an EV stock that has plummeted by 62% year-to-date, 5-star investor Gary Alexander believes the time is right to load up, citing its lower valuation as a compelling reason.

“Fears are currently exaggerated for Rivian, which remains a highly recognizable, rapidly scaling electric vehicle maker. I’d take advantage of currently depressed share prices as a very opportune buying moment,” Alexander went on to say.

Rivian is far from the only EV stock to have taken a big beating this year, with the once-trendy sector suffering from a combination of weakening demand, a jittery macro backdrop and intensifying competition with many incumbents vying for a piece of the fledgling industry. It’s highly probable only a select few names will make it through to the other side, and Alexander thinks Rivian boasts the credentials to do so.

While its share losses can partly be attributed to the prevailing negative sentiment towards EVs, other factors have contributed as well. Rivian’s flat production forecast for the year failed to meet expectations, and the recent announcement by auto giant Ford of price reductions on its own F-150 Lightning electric truck poses a challenge to Rivian’s competitiveness. However, despite these setbacks, Rivian still possesses numerous strengths.

According to Alexander, Rivian has a “differentiated brand” setting it apart from segment leader Tesla, boasts a well-established partnership with Amazon and it has $7+ billion of cash that provides “ample liquidity as it continues to scale.”

Moreover, it has taken meaningful strides to get its profitability profile in shape, improving gross profit per unit by over $80,000 last year, while expecting to reach gross margin profitability by the end of 2024. There’s also a more affordable vehicle in the pipeline, the R2, a midsize SUV that will be going for as low as $45,000, although it will only be available in 2026.

“All in all,” Alexander summed up, “with the recent crash in share prices, I am upgrading my viewpoint on Rivian to Strong Buy and recommend investors buy this dip aggressively.” (To watch Alexander’s track record, click here)

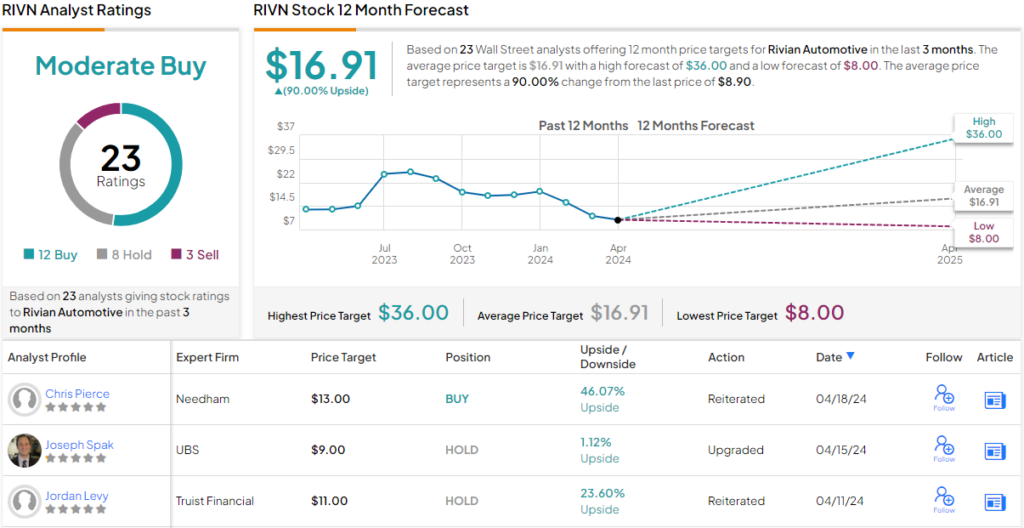

The Street analysts offer a more balanced perspective, though the bulls still driving the narrative. With a combination of 12 Buy recommendations, 8 Holds, and 3 Sells, the stock claims a Moderate Buy consensus rating. Most certainly think the shares are now undervalued; at $16.91, the average target represents one-year returns of 90%. (See Rivian stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.