Boeing (NYSE:BA) has been grabbing the headlines again recently and once more for all the wrong reasons.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Since a cabin panel blew off shortly after takeoff of an Alaska Airlines MAX 9 jet earlier this month, the company has been in crisis mode. Meanwhile, in order to carry out safety inspections, the U.S. Federal Aviation Administration (FAA) has temporarily grounded 171 aircraft.

The market responded the way it usually does when a negative event unfolds – by sending shares down, of course. The stock has already shed 19% this year, with an almost 8% decline taking place on Tuesday.

That drop, says Deutsche Bank analyst Scott Deuschle, had “the air of capitulation to it.” In fact, despite the “cloud of uncertainty” currently engulfing Boeing, the analyst thinks BA’s “risk/reward profile is attractive.”

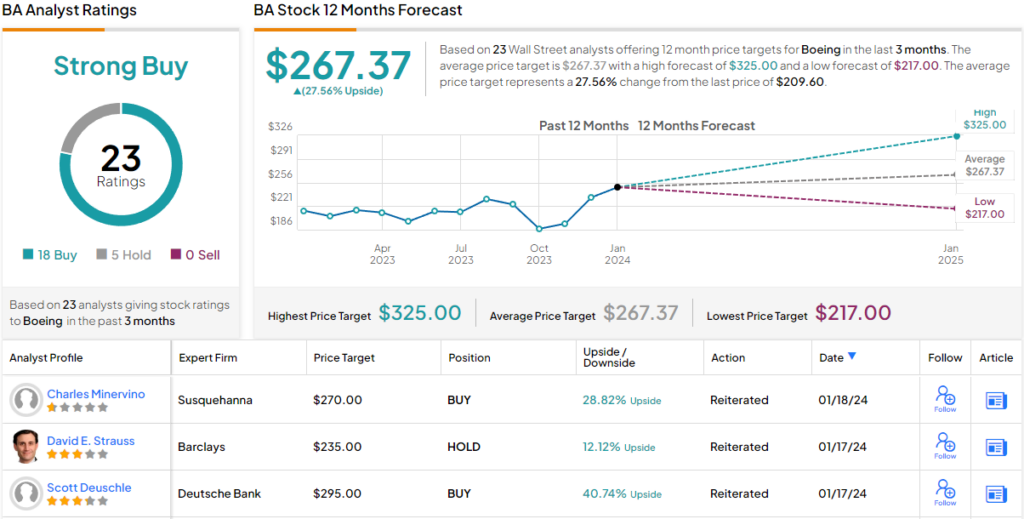

Hence, Deuschle reiterated a Buy rating on the stock, while his $295 price target factors in 12-month returns of ~41%. (To watch Deuschle’s track record, click here)

Deuschle’s comments come ahead of Boeing’s 4Q23 print, slated for January 31st. For the quarter, Deuschle is calling for FCF of $2.8 billion, some distance above consensus at $1.9 billion.

“We see upside vs. the Street primarily driven by favorable working capital dynamics as we think both advances and inventories are likely a source of cash,” the analyst explained. “Inventory should benefit from liquidations on both 737 and 787, as well as some potential reduction on certain supplier inventories. We think advances should benefit from strong 4Q order activity.”

Moreover, depending on the timing of deposit payments for recent orders, Deuschle sees further upside to his FCF forecast, noting the potential for FCF above $3 billion.

For 2024, Deuschle expects the company will guide for FCF between $4.0-6.0 billion, ~500-550 737 deliveries, and 90-100 787 deliveries. However, this forecast is contingent on an increase in deliveries in the coming weeks. Deuschle acknowledges that if this increase does not materialize, Boeing’s guidance could become more uncertain.

So, that’s Deutsche Bank’s take, what does the rest of the Street have in mind for BA? Most (unlike some of Boeing’s panels) remain on board. Based on a mix of 18 Buys vs. 5 Holds, the stock claims a Strong Buy consensus rating. Going by the $267.37 average target, a year from now, shares are expected to generate returns of ~28%. (See Boeing stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.