Nvidia (NASDAQ:NVDA) takes center stage today as it prepares to report earnings, and the stakes couldn’t be higher. As the undisputed leader in the AI boom that’s driven market gains over the past two years, Nvidia’s results are seen as a barometer for what’s next.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While some investors are holding their breath amid chatter about tariffs and curbs on AI chip exports to China, Loop Capital’s Ananda Baruah isn’t flinching. Instead, the analyst is brushing aside the caution and betting on strength.

“Lots of moving parts,” says Baruah ahead of the print, “but the gist is our work suggests NVDA’s Apr Q print and July Q guide can be ‘good enough’ vs. Street to support the stock into what we believe is a 2HCY2025 materially stronger than Street.”

Beneath the surface of all the market noise, Baruah’s analysis indicates that demand has stayed strong through the April quarter. He also notes that Nvidia records revenue when it sells products to its partners (sell-in). Since demand is currently limited by product availability, Baruah believes Nvidia can take advantage of this sell-in model by booking revenue upfront. At the same time, its partners are likely to move the inventory quickly in the upcoming quarters.

As for the following quarters, Baruah thinks Street expectations for CY2025/FY2026 remain “materially low.” Over the past six months, there’s been a significant shift in Nvidia’s product mix toward its newer Blackwell GPUs, which has boosted the company’s ASPs (average selling prices) – a positive trend that’s not fully appreciated by the market. The analysis indicates that for the calendar year 2025 (fiscal 2026), the average ASP has increased to around $33K, up from $26K just six months ago for the same timeframe.

Initially, for CY2025/FY2026, Nvidia appeared to be planning for a roughly equal split of 2.5 million units each of Hopper and Blackwell GPUs. However, Baruah now thinks the vast majority of units sold during the period will be Blackwell. Supporting this view, key generative AI server manufacturers – such as Supermicro and Hewlett Packard – have begun writing down their Hopper inventory (with Dell’s position still unclear).

Looking even further ahead, the analyst’s findings, made in collaboration with Loop Capital’s supply chain expert John Donovan, continue to indicate that demand for GPUs in CY2026 (F2027) is expected to exceed 8 million units, up from over 6 million units projected for this year. It’s also worth highlighting that Baruah’s forecast for CY2025 (F2026) does not account for the potential demand from the recent announcement of over 1 million GPUs destined for entities in the Middle East. Moreover, it’s unclear whether it includes the news from Elon Musk about a new xAI data center in Memphis, which plans to add another 1 million GPUs within the next 6 to 9 months.

Bottom line, ahead of the print, Baruah rates NVDA shares a Buy, alongside a $175 price target. If met, the figure could yield returns of ~29% over the one-year timeframe. (To watch Baruah’s track record, click here)

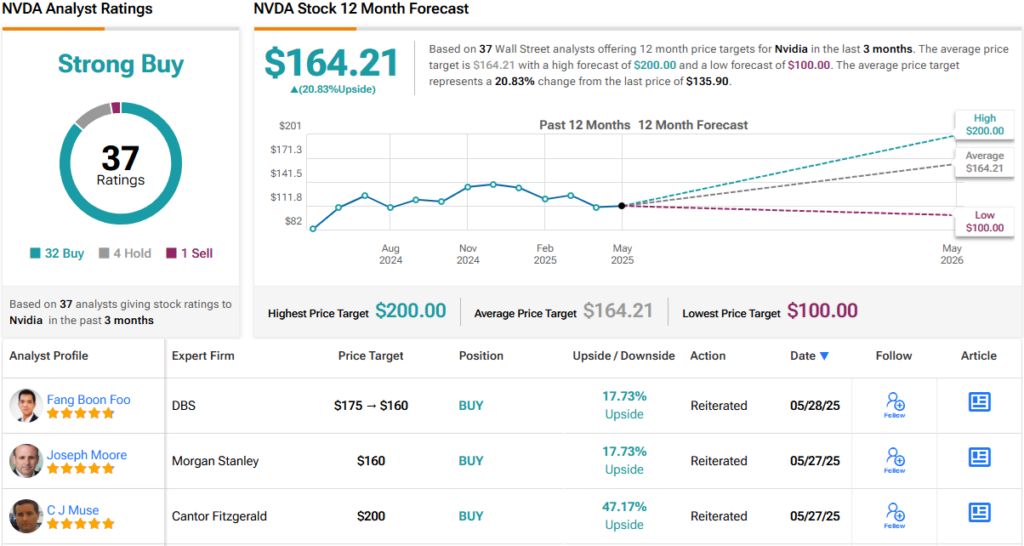

Elsewhere on the Street, NVDA stock claims an additional 31 Buys, 4 Holds and 1 Sell, for a Strong Buy consensus rating. Going by the $164.21 average price target, a year from now, shares will be changing hands for a ~21% premium. (See NVDA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.