Eli Lilly (LLY) stock rallied on Thursday after the pharmaceutical company posted its Q3 2025 earnings report. This report started with adjusted earnings per share of $7.02, which was well above Wall Street’s estimate of $5.69. It also represented a 494.9% increase year-over-year from $1.18 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Revenue reported by Eli Lilly came in at $17.6 billion, which was another beat compared to analysts’ estimate of $16.05 billion. It also climbed 54% year-over-year compared to $11.44 billion. Revenue growth was driven by a 62% increase in volume and was offset by a 10% decrease due to lower realized prices. The company’s Key Products1 revenue grew to $11.98 billion during the quarter, led by Mounjaro and Zepbound.

Eli Lilly stock was up 5.16% in pre-market trading on Thursday, following a 0.8% dip yesterday. The shares have climbed 6.01% year-to-date and have increased 1.95% over the past 12 months.

Eli Lilly Guidance

Eli Lilly also updated its full-year 2025 guidance in its latest earnings report. The company expects adjusted EPS to range from $23 to $23.70, alongside revenue of $63 billion to $63.5 billion. For comparison, Wall Street’s estimates for the period include adjusted EPS of $22.50 and revenue of $61.63 billion.

Also looking to the future, Eli Lilly Chairman and CEO David A. Ricks stated, “We advanced orforglipron through four additional Phase 3 trials, enabling global obesity submissions by year-end, and we achieved U.S. FDA approval of Inluriyo (imlunestrant)—marking key progress across our pipeline. We continue to increase manufacturing capacity, announcing new facilities in Virginia and Texas and an expansion of our site in Puerto Rico.”

Is Eli Lilly Stock a Buy, Sell, or Hold?

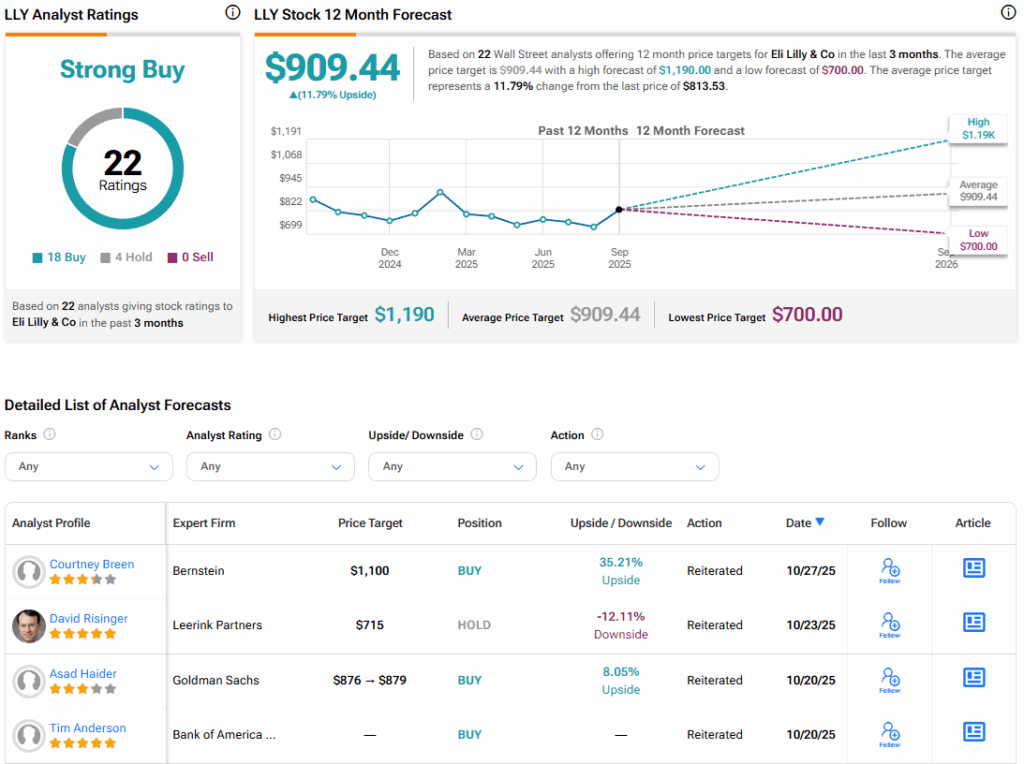

Turning to Wall Street, the analysts’ consensus rating for Eli Lilly is Strong Buy, based on 18 Buy and four Hold ratings over the past three months. With that comes an average LLY stock price target of $909.44, representing a potential 11.79% upside for the shares. These ratings and price targets will likely change as analysts update their coverage after today’s earnings report.