Ticketmaster, a unit of the global entertainment company Live Nation Entertainment (NYSE:LYV), has bowed to the Biden Administration’s crackdown on hidden fees charged on tickets. America’s largest concert ticket seller has agreed to follow more transparency in their ticketing services by showing an all-inclusive, upfront cost of tickets to customers online. This move aims to promote competition and reduce ticket costs. Investors cheered the news and sent the stock up 3.7% on June 15.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Ticketmaster and SeatGeek are among the two biggest entertainment companies that sell tickets for concerts and sports events in the U.S. Following the push, Live Nation will start showing the total, all-inclusive price to customers at more than 200 venues starting in September. Similarly, SeatGeek will make the changes by the end of summer to boost healthy ticketing practices.

Here’s What the Biden Administration Seeks

Since last year, the Biden Administration has been pushing companies from the travel, entertainment, and airline industries to adopt a practice of upfront disclosure for all hidden costs associated with tickets, instead of adding them at the end point of checkout. The crackdown became severe after Ticketmaster was probed by the DOJ for possible misconduct related to the ticket sale of Taylor Swift’s live concert “Eras Tour.”

Following an event at the White House yesterday, President Biden confirmed the commitment of both Ticketmaster and SeatGeek to practice fair ticketing. He was joined by executives from the industries in question, including Live Nation, SeatGeek, Airbnb (NASDAQ:ABNB), and TickPick.

What is the Forecast for Live Nation?

Recently, Benchmark analyst Matthew Harrigan reiterated a Buy rating on LYV stock with a price target of $110 (21.8% upside potential). Overall, the stock has a Moderate Buy consensus rating on TipRanks based on five Buys and two Hold ratings. Also, the average Live Nation Entertainment price target of $93.29 implies 3.3% upside potential from current levels.

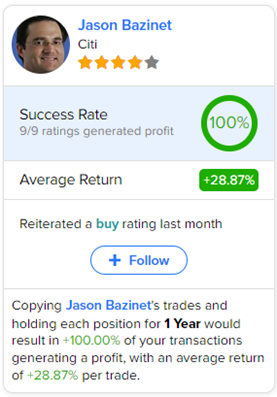

Further, investors looking for the most accurate analyst for LYV could follow Citi analyst Jason Bazinet. Copying his trades on this stock and holding each position for one year could result in 100% of your transactions generating a profit, with an average return of 28.87% per trade.