There’s a surprising drama shaping up in the Australian lithium market. In recent years, Australia has pushed up its efforts to become a greater producer of this crucial metal, and near the tip of the spear has been Gina Rinehart, an Australian billionaire. She’s been buying up large quantities of Liontown Resources (ASX:LTR), and that’s making things difficult for Albemarle (NYSE:ALB). But it’s not that bad of news, as Albemarle is up nearly 3.5% in Tuesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The latest news from Hancock Prospecting explains, at least somewhat, why Rinehart got in further. Liontown is working to develop a major lithium deposit in Western Australia, and that’s in line with other reports suggesting that Rinehart is actively interested in getting in on the lithium market. With the sheer number of uses for lithium—particularly in green technology—there’s plenty of reason why getting in on lithium is a good play. But with Rinehart increasing her stake from 16.69% to 18.36%, she’s getting close to the point where she may have to buy the whole thing under Australian law.

That will put her up against Albemarle, who was planning to make a play of its own for Liontown. And with lithium in high demand—a report from Tesla (NASDAQ:TSLA) says that Tesla, by itself, will need 1,000 kilotons of lithium carbonate equivalent annually by 2030—getting hands on the Australian lithium supply and infrastructure could mean huge returns for its owners.

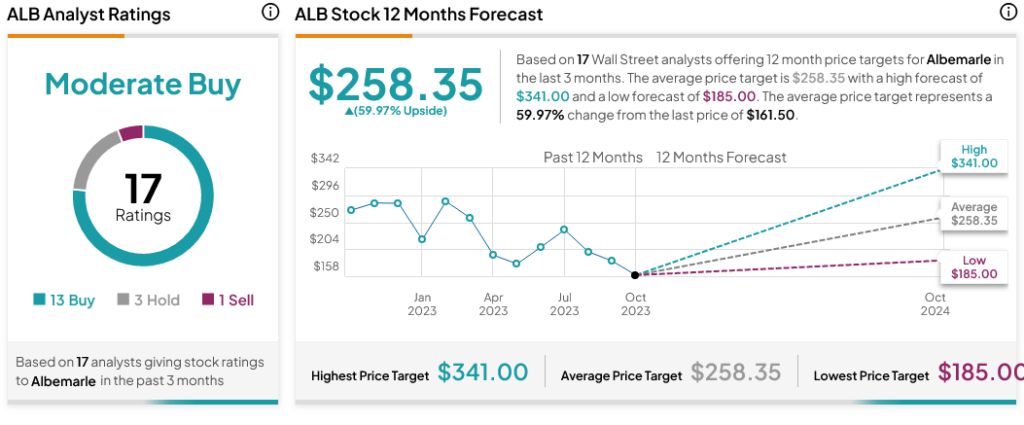

Is Albemarle a Buy, Hold, or Sell?

Albemarle may have its hands full fending off an Australian billionaire, but it’s still in great shape with analysts. With 13 Buy ratings, three Holds and one Sell, Albemarle is considered a Strong Buy. Further, Albemarle’s average price target of $258.35 offers investors 59.97% upside potential.