New reports from Canadian payments company Lightspeed Commerce (TSE:LSPD) (NYSE:LSPD) suggest that the company doesn’t have much problem at all with going private. That’s a concept that got a lot of investors thinking with their wallets. In fact, Lightspeed picked up nearly 5% in Monday morning’s trading thanks to the news.

Apparently, the recent possibility of Nuvei (TSE:NVEI) (NASDAQ:NVEI) getting bought out itself was enough to make Lightspeed wonder if a similar path would do it well. After all, when the word first emerged about Nuvei potentially getting bought up, that sent Nuvei shares on an upward tear, giving it an extra 30% in its market cap at one point.

Since Lightspeed occupies a similar market space, the idea that Lightspeed could do well going private itself makes some sense. However, that doesn’t mean it’s making moves in that direction. Still, reports note that CEO Dax Dasilva is at least looking into the matter, if only out of sheer curiosity.

Lightspeed Rolls Out New Software Product

Yet, even as Lightspeed considers going private, it looks to its own future in case going private doesn’t turn out to be that useful after all. In fact, it recently rolled out a new software product: Lightspeed Restaurant. While, at first, you might wonder where you can find a menu, it’s actually a payment tool specifically geared for restaurants.

The new tool comes at a good time for the beleaguered restaurant trade, which is seeing increasing operational costs and some revenue downturns as well. However, with food service sales expected to reach $18.7 billion by 2026, there’s an opportunity here, and Lightspeed can help businesses reach it.

Is Lightspeed Stock a Buy or Sell?

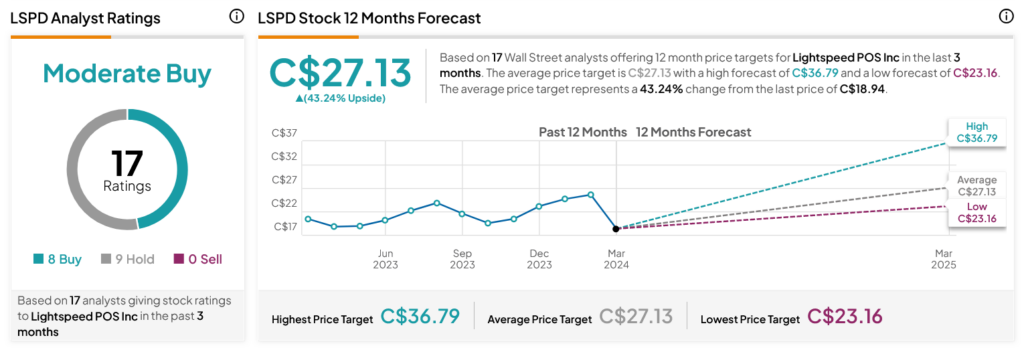

Turning to Wall Street, analysts have a Moderate Buy consensus rating on LSPD stock based on eight Buys and nine Holds assigned in the past three months, as indicated by the graphic below. After a 6.23% loss in its share price over the past year, the average LSPD price target of C$27.13 per share implies 43.24% upside potential.