Shares of the provider of point-of-sale and e-commerce software, Lightspeed Commerce (TSX: LSPD) (NYSE: LSPD) crashed in morning trading at the time of publishing on Thursday after the company issued disappointing fiscal Q1 guidance. The company has now projected Q1 revenues to be in the range of $195 million to $200 million below the consensus estimates of $207.4 million.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Lightspeed has projected an adjusted EBITDA loss of around $10 million in fiscal Q1 which includes “includes costs associated with launching the unified POS and payments initiative, as well as approximately $4 million in costs associated with our annual sales summit.”

In FY24, the company has forecasted revenues between $875 million and $900 million, with growth expected to be stronger in the second half of the year after rollout of unified payments. For the full year, the company anticipates breaking even or better adjusted EBITDA.

Lightspeed commented on the softer-than-expected outlook that “reflects caution on the near term results given the economic climate and its impact on the Company’s end markets (including changes in consumer spending impacting several of Lightspeed’s retail verticals).”

In the fiscal fourth quarter, Lightspeed posted total revenues of $184.2 million, up by 27% year-over-year on a constant currency basis, versus analysts’ estimates of $183.92 million. The company broke even on an adjusted earnings per share basis while analysts were expecting the company to report a loss of $0.03 per share.

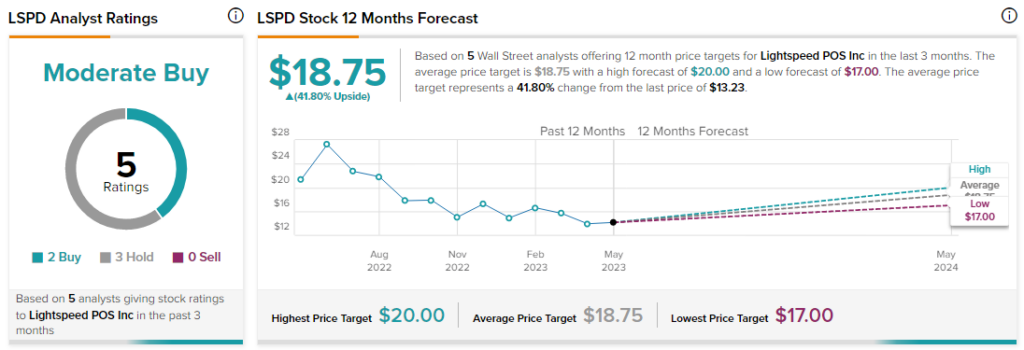

Analysts are cautiously optimistic about LSPD stock with a Moderate Buy consensus rating based on two Buys and three Holds.