Li Auto (LI) reported its unaudited Q2 financial results today. Its revenues disappointed: at $1.30 billion, they represented a decrease of 8.7% from its Q1 2022 earnings. Although revenue jumped 73.3% from Q2 2021, investors still responded by selling the stock, and the stock is down 5.1% in pre-market trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Nio, (NIO) also a Chinese EV company, is seeing selling action on its stock in pre-market trading as well. Investors seem concerned that Nio will show poor performance when it reports its Q2 earnings next month, so the stock is down 2.2%, at the time of writing.

Is NIO or LI a Better Buy?

Analysts have a similarly positive outlook on both NIO and LI stocks. However, LI might be a slightly better buy, with a Smart Score of 9 against NIO’s Smart Score of 8.

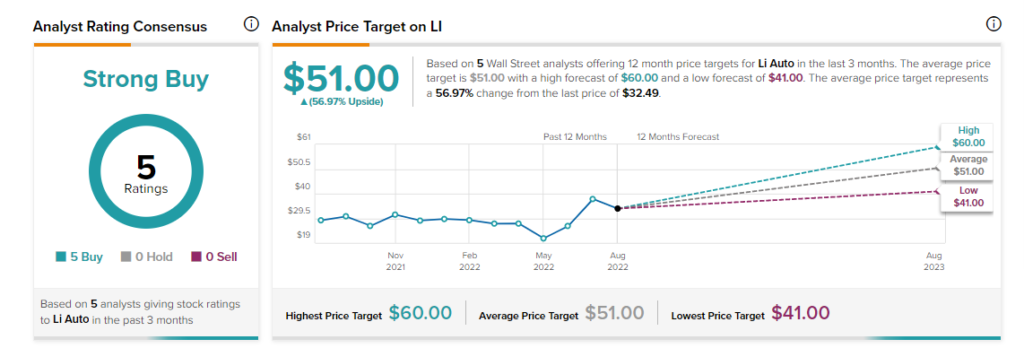

Analysts have been optimistic about LI stock, with all five analysts rating the stock in the past three months giving it a Buy. The stock has a Strong Buy analyst consensus, representing 57% upside potential. It remains to be seen how analysts will respond to the Q2 revenue results.

NIO stock is a Strong Buy as well, according to the 11 analysts who rated the stock in the past three months. Nio has a 57% upside potential as well.