Chinese vehicle maker Li Auto (NASDAQ:LI) has so far impressed analysts with its delivery numbers. The company announced that it delivered 41,030 vehicles in November, up 172.9% year over year. Moreover, its cumulative year-to-date deliveries reached 325,677, achieving its 2023 target of 300,000 ahead of schedule. As Li Auto’s deliveries continue to shine, analysts favor the stock and express confidence in its prospects.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The company’s CEO, Xiang Li, noted that the robust demand for the three Li L series models enabled the company to deliver more than 40,000 vehicles in two consecutive months. He added that the increasing market demand will lead the automaker to deliver 50,000 cars in December.

As Li Auto hits the right chords with solid delivery numbers, let’s look at the Street’s recommendation for its stock.

What is the Future of LI Stock?

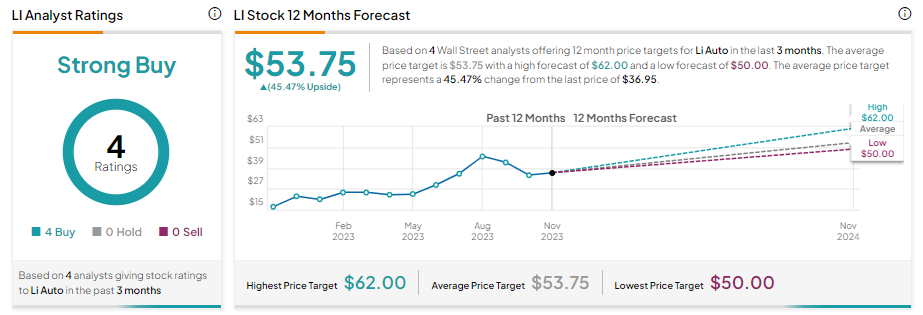

Li Auto stock has risen over 76% year-to-date. However, analysts see significant upside potential in LI stock from current levels. Higher deliveries, improving margins, and the launch of its EV (electric vehicle) Mega keep analysts bullish.

Four analysts cover LI stock and recommend a Buy. Further, analysts’ average price target of $53.75 implies 45.47% upside potential over the next 12 months.