Shares of Li Auto (NASDAQ: LI) were on an upswing in pre-market trading on Monday after the Chinese EV major stated that it expects its vehicle deliveries to zoom up between 64% and 73.4% in Q1 to be between 52,000 and 55,000 vehicles.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Moreover, the company expects robust revenues in the first quarter between $2.5 billion and $2.68 billion, an increase of 82.5% to 93% year-over-year.

Li reported adjusted earnings for its fourth quarter of $0.13 per ADS, surpassing analysts’ consensus estimate of $0.07.

Total revenues increased by 66.2% year-over-year to $2.56 billion, in line with estimates.

Xiang Li, founder, Chairman, and CEO of Li Auto commented, “We ended the year on a high note, with record deliveries of more than 20,000 vehicles in December, setting a new milestone for our company and emerging new energy automakers in China.”

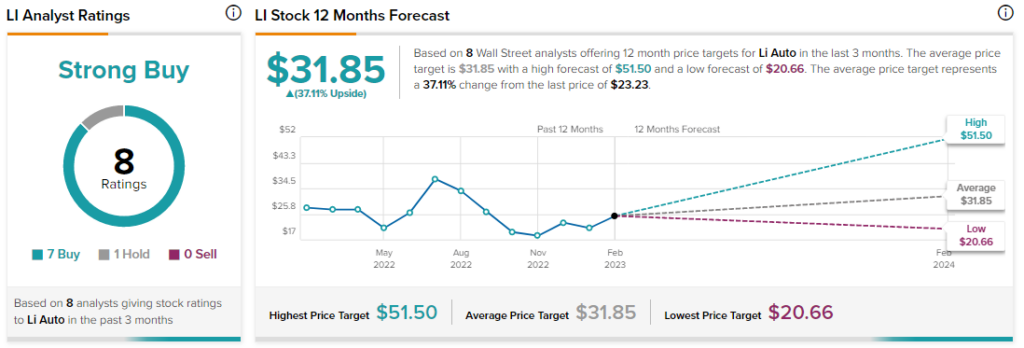

Overall, Wall Street analysts are bullish about LI stock with a Strong Buy consensus rating based on seven Buys and one Hold.