Shares of Levi Strauss & Co (NYSE: LEVI) slid in morning trading on Thursday after the jeanswear company guided for a cautious outlook in FY23 and now expects revenues between $6.3 billion and $6.4 billion versus analysts’ expectations of $6.31 billion. It has projected FY23 adjusted diluted earnings in the range of $1.30 to $1.40 while analysts had anticipated earnings of $1.33 per share.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Harmit Singh, CFO of Levi Strauss & Co. commented, “Our teams also made significant progress reducing inventory levels, putting us in a stronger position as we move through the balance of the year. We are reaffirming our annual revenue and EPS guidance reflecting a cautious outlook on the macro-environment though we remain excited about the momentum in our DTC [direct-to-consumer] and international businesses.”

The company reported adjusted earnings of $0.34 per share in the fiscal first quarter versus $0.46 in the same period last year and exceeding consensus estimates of $0.32 per share. Sales increased by 6% year-over-year to $1.7 billion. This beat analysts’ expectations of $1.62 billion.

LEVI also declared a dividend of $0.12 per share payable in cash on May 18, to the holders of record of Class A common stock and Class B common stock at the close of business on May 4, 2023.

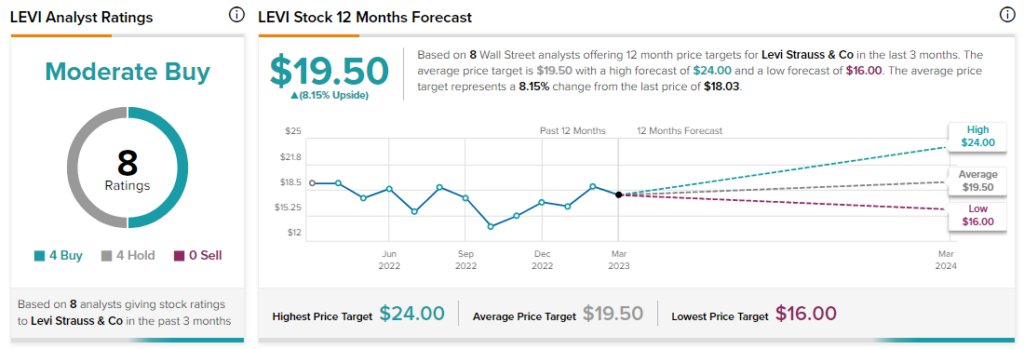

Overall, analysts remain cautiously optimistic about LEVI stock with a Moderate Buy consensus rating based on four Buys and four Holds.