Lucid Group (NASDAQ:LCID) shares tanked at the time of writing as the electric vehicle company revealed its Q2 production and delivery numbers. The company managed to churn out 2,173 vehicles from its Arizona facility and sent 1,404 of those freshly minted EVs to new homes during the same timeframe. This missed the consensus estimate of 1,873 deliveries. Furthermore, Lucid started shipping parts to Saudi Arabia this quarter.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

With eyes on the future, Lucid is all set to announce its complete Q2 earnings on August 7. The word on the street is that it’s expected to report revenue of $233 million and an EPS of -$0.37.

What is the Future Price of LCID Stock?

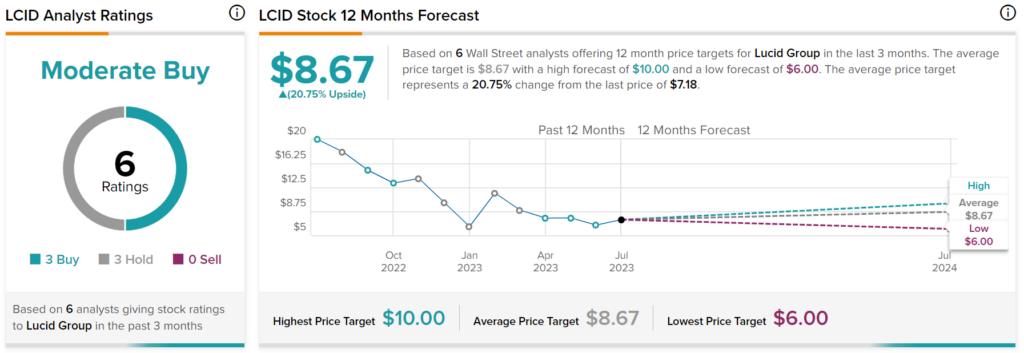

Turning to Wall Street, analysts have a Moderate Buy consensus rating on LCID stock based on three Buys, three Holds, and zero Sells assigned in the past three months, as indicated by the graphic above. Nevertheless, the average price target of $8.67 per share implies 20.75% upside potential.