Lucid Group (LCID) stock declined about 3% after posting lower-than-expected third-quarter results. The fall came even after the automaker got a major liquidity boost from its largest backer, the Public Investment Fund (PIF) of Saudi Arabia. Alongside earnings, the company also disclosed several leadership changes to speed up growth, simplify decisions, and boost accountability as it expands globally.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The automaker delivered a Q3 adjusted loss per share of $2.65, which came wider than the analysts’ consensus estimate of a loss of $2.29 per share. However, it slightly improved from a loss of $2.76 in the year-ago quarter.

Meanwhile, the company’s Q3 revenue rose by 68% year-over-year to $336.6 million but missed the analysts’ estimates of $370.6 million. The top-line growth was driven by 4,078 vehicles delivered during the quarter, up 47% compared to Q3 2024.

Liquidity Strengthened with $2B DDTL Expansion

In a major post-quarter development, Lucid and PIF agreed to expand the company’s Delayed Draw Term Loan (DDTL) facility from $750 million to $2.0 billion. While the facility remains undrawn, it significantly bolsters Lucid’s financial flexibility.

It must be noted that if the increase had been reflected in the third quarter results, total liquidity would have reached $5.5 billion, up from the reported $4.2 billion.

This move signals PIF’s confidence in Lucid and gives the company more flexibility to fund growth, such as boosting production and advancing self-driving tech.

Lucid CFO Taoufiq Boussaid said, “We remain sharply focused on cost management, with our solid liquidity position, supported by the additional liquidity from the PIF, underpinning both our short-term execution and our mid-term strategy.”

Key Leadership Changes

Lucid announced key leadership changes today. The company promoted Emad Dlala to Senior Vice President (SVP) of Engineering and Digital, now overseeing product development, along with his existing powertrain organization.

Also, Erwin Raphael is now SVP of Revenue, leading global sales and service as Lucid expands into new markets.

Finally, Marnie Levergood is joining the company as SVP of Quality, taking over from Jeri Ford, who is retiring after 35 years in the auto industry.

What Is the Price Target for LCID Stock?

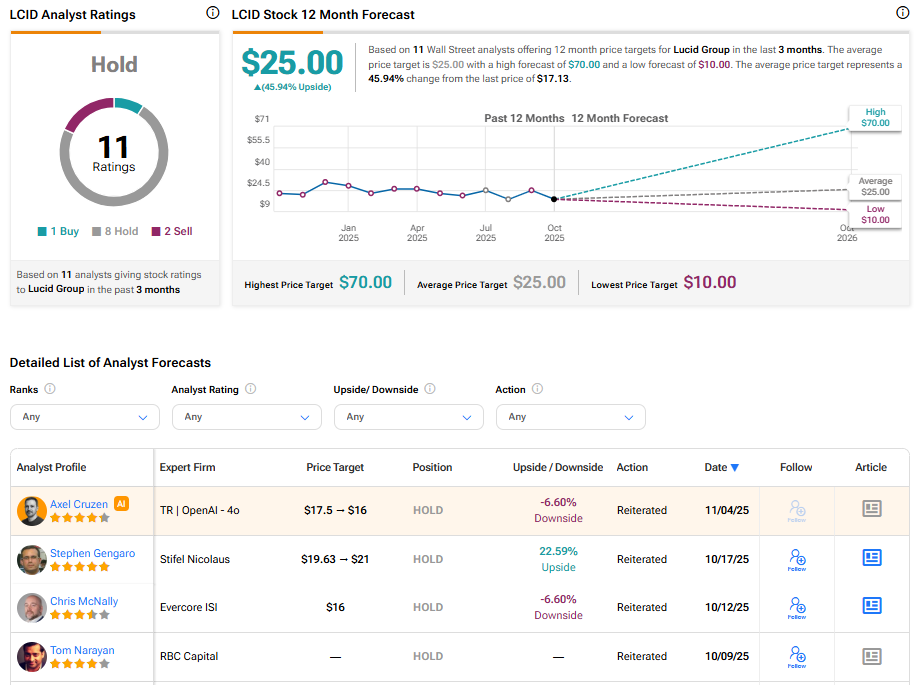

Turning to Wall Street, LCID stock has a Hold consensus rating based on one Buy, eight Holds, and two Sell recommendations issued in the past three months. The average LCID price target of $25.00 implies 45.94% upside from current levels.

It must be noted that analysts may update their price targets for LCID stock after this earnings report.