Shares of Lucid Group (NASDAQ:LCID) fell in after-hours trading after the company reported earnings for its fourth quarter of Fiscal Year 2022. Earnings per share came in at -$0.28, which beat analysts’ consensus estimate of -$0.41 per share. Sales increased by 876.5% year-over-year, with revenue hitting $257.7 million. However, this missed analysts’ expectations of $273.59 million.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Lucid revealed it produced 3,493 vehicles in the fourth quarter. That’s up 53% quarter-over-quarter. However, of the vehicles produced, it only delivered 1,932 vehicles, which missed the consensus expectation of 2,831. Nevertheless, Lucid produced 7,180 vehicles in 2022, exceeding its guidance of 6,000 to 7,000. In addition, it delivered 4,369 vehicles.

Looking forward, Lucid plans to produce roughly the same amount of vehicles as it did this quarter in the next four quarters, turning out between 10,000 and 14,000 vehicles over the course of fiscal 2023. Meanwhile, reports noted its order book is down to 28,000 total vehicles.

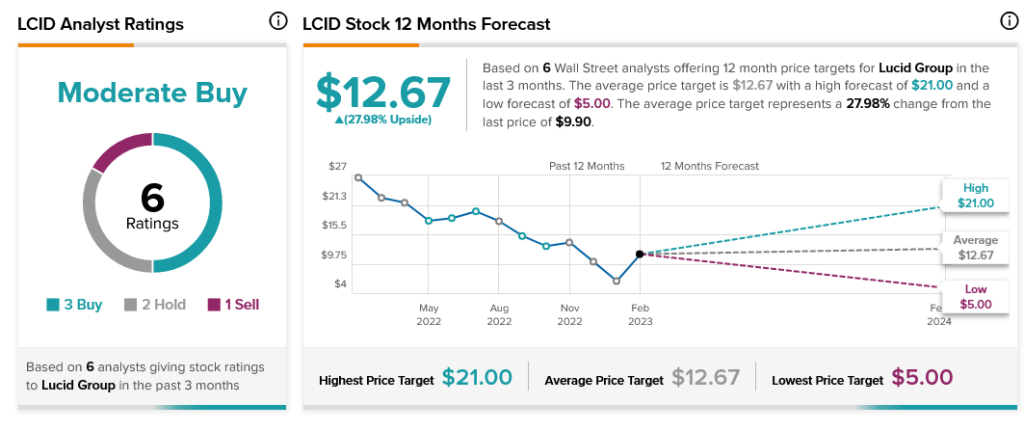

Overall, Wall Street has a consensus price target of $12.67 on Lucid Group, implying 27.98% upside potential, as indicated by the graphic above.