Apple (NASDAQ:AAPL) is implementing cost control measures as a result of its declining top line and growing market unpredictability. Interestingly, these measures do not involve the employee layoff strategy. Instead, the tech giant plans to delay bonus payouts for some corporate divisions and is expanding its hiring freeze to additional positions, Bloomberg reported.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Earlier, the company distributed bonuses in two installments, one each in April and October. In the future, it intends to make the payment just once, in the second half of 2023.

In other cost-cutting moves, Apple is reducing the travel budgets for many teams and introducing a new rule that requires budgets to be approved by the senior vice president.

It is worth mentioning that Apple has been able to avoid mass layoffs so far. The key reason is that the company did not hire excessively during the pandemic. This is in sharp contrast to its peer, Meta Platforms (META). Meta recently announced another round of massive layoffs.

Is Apple a Buy or Sell?

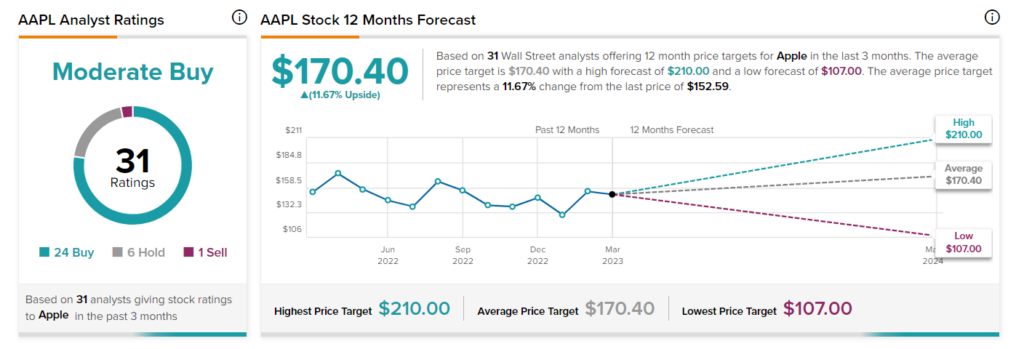

AAPL stock has a Moderate Buy consensus rating based on 24 Buys, six Holds, and one Sell. The average price target of $170.40 implies an upside potential of 11.7% from the current level. Shares of the company have gained 22.2% so far this year.

Also, Apple sports a “Perfect 10” Smart Score, implying it has the potential to beat the broader market averages.