Shares of Las Vegas Sands Corp. (NYSE: LVS) gained in pre-market trading on Thursday after the casino and resort company swung to a profit in Q1 with adjusted earnings of $0.28 per diluted share versus a loss of $0.40 per share in the same period last year and beating consensus estimates of $0.20.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The company generated net revenues of $2.12 billion versus $943 million in the same period last year and surpassing analysts’ expectations of $1.85 billion.

In Macau, LVS’s adjusted property EBITDA reached $398 million after a loss of $11 million in the same period last year and for the first time since 2019, Macau’s property portfolio mass gaming revenue reached $1 billion.

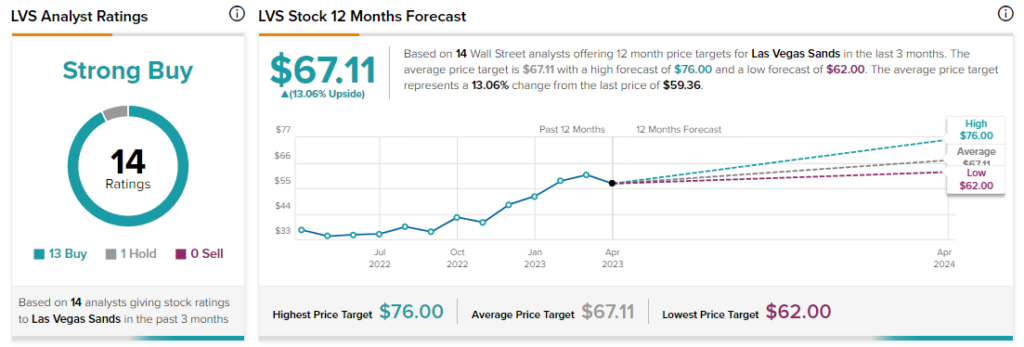

Top-rated Barclays analyst Brandt Montour is bullish about the stock with a Buy rating and raised the price target on Las Vegas Sands to $69 from $64 following the Q1 earnings. The analyst’s price target implies an upside potential of 16.2% at current levels. Montour was impressed by the company’s Q1 results and sees an “attractive catalyst path ahead” for the shares.

Overall, Wall Street has a consensus price target of $67.11 on LVS stock, implying a 13.1% upside potential, as indicated by the graphic above.