Large U.S. banks will have to pay most of the special fees decided by the Federal Deposit Insurance Corporation (FDIC) to replenish the deposit insurance fund that has been drained of nearly $16 billion due to the collapse of regional Silicon Valley Bank and Signature Bank in March.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The FDIC has proposed a special assessment fee for 113 banks, with large banks having assets worth at least $50 billion to pay more than 95% of the total cost. Banks with assets below $5 billion will be spared from paying the special fee. The bank regulator proposes to apply the special assessment fee at an annual rate of 0.125% to the lenders’ uninsured deposits in excess of $5 billion. The special charge, which is subject to potential changes, will be collected over eight quarters beginning in June 2024.

Banks generally pay a quarterly fee to support the deposit insurance fund. However, the FDIC explained that the special assessment fee was required to recover the cost associated with protecting uninsured depositors following the closures of Silicon Valley Bank and Signature Bank. Both banks had elevated levels of uninsured deposits and collapsed after customers withdrew huge amounts amid concerns over their financial strength. The seizure of First Republic and its sale to JPMorgan Chase (NYSE:JPM) is expected to hit the deposit insurance fund by an additional $13 billion.

Citing Credit Suisse analyst Susan Roth Katzke, Reuters noted that the country’s top 14 banks will be required to pay an estimated $5.8 billion under the special assessment fee, which could impact their earnings per share by 3% (median estimate). JPMorgan is expected to pay an annual fee of $1.3 billion, while Bank of America (NYSE:BAC) and Wells Fargo (NYSE:WFC) are estimated to pay $1.1 billion and $898 million, respectively.

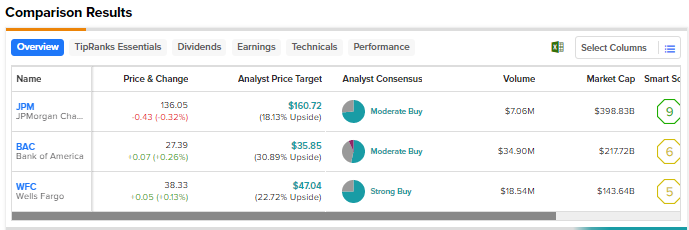

Let’s take a look at Wall Street’s ratings for these three large banks.

Wall Street’s Moderate Buy rating for JPMorgan is based on 14 Buys and five Holds. The average price target of $160.72 suggests 18.1% upside.

The Moderate Buy consensus rating for Bank of America is based on eight Buys, six Holds, and one Sell. The average price target of $35.85 implies nearly 31% upside.

With 12 Buys and four Holds, Wells Fargo earns a Strong Buy consensus rating. At $47.04, the average price target implies 22.7% upside potential.