Leading frozen potato products provider Lamb Weston (NYSE:LW) is scheduled to announce its fiscal second-quarter results on January 5, before the market opens. Analysts expect the food processing company to generate strong earnings growth despite inflationary pressures and supply chain issues.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Analysts’ Q2 Expectations

Lamb Weston delivered mixed results for the first quarter of Fiscal 2023 (ended August 28, 2022). The company’s Q1 FY23 sales grew 14.4% year-over-year to $1.13 billion but lagged analysts’ expectations. Meanwhile, adjusted earnings per share (EPS) increased over 31% to $0.75 and exceeded estimates. The company’s earnings benefited from higher pricing and a favorable product mix.

Lamb Weston’s pricing actions and productivity savings helped in offsetting lower volumes and a rise in input, manufacturing, and transportation costs. The company reaffirmed its full-year revenue and earnings guidance following the Q1 results. It expects FY23 sales in the range of $4.7 billion to $4.8 billion and adjusted EPS of $2.45 to $2.85.

Meanwhile, analysts expect Lamb Weston’s Q2 adjusted EPS to increase 48% to $0.74, driven by improved margins and a 14% growth in revenue to $1.15 billion. While the company anticipates volatility in restaurant traffic and demand trends through FY23, it remains confident about long-term growth potential in the U.S. and key international markets.

Is Lamb Weston a Good Stock to Buy?

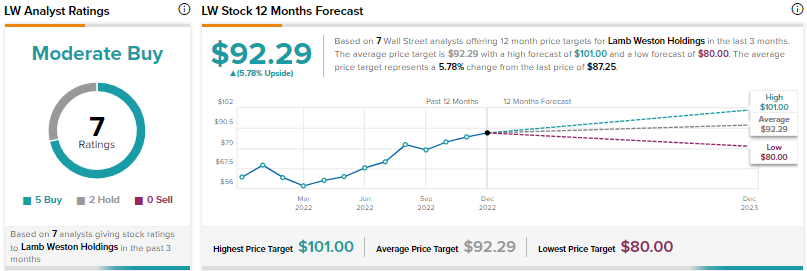

Wall Street is cautiously optimistic about Lamb Weston stock, with a Moderate Buy consensus rating based on five Buys and two Holds. The average LW stock price target of $92.29 implies nearly 6% upside potential. Shares have rallied about 40% over the past year.

Conclusion

Despite cost inflation and supply chain bottlenecks, analysts expect Lamb Weston to report strong growth in its Q2 FY23 earnings, fueled by increased prices and productivity initiatives. As per TipRanks, Lamb Weston scores a “Perfect 10,” which indicates that the stock has the potential to outperform the market averages over the long term.