Lam Research (NASDAQ:LRCX) got a hefty boost in Thursday afternoon’s trading as Wall Street debated whether or not the semiconductor company had finally found a bottom. Indeed, investors piled in and sent shares up over 7% at the time of writing.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Lam Research posted earnings of $6.99 per share, which beat expectations of $6.53. Revenue was also a win as Lam posted $3.87 billion against the $3.85 billion consensus estimate. Despite these wins, though, Lam stock still lost ground initially. That was most likely because of Lam’s less-than-exciting guidance. Analysts were expecting $5.55 per share in earnings and $3.45 billion in revenue for the fourth quarter. Lam, meanwhile, expects to falter on earnings, looking for $4.75 per share, plus or minus $0.75. It is also expected to fail on revenue, coming in between $2.8 billion and $3.4 billion.

One of the biggest problems limiting Lam’s revenue, it noted, was continued restrictions on sales to China. However, Lam received some praise from analysts; Morgan Stanley’s Joseph Moore noted that the company did have “earnings and cash generation power,” though investors should be “cautious” about the second half. Interestingly, Steve Barger of KeyBanc Capital Markets suggested that the next quarter might actually be the trough.

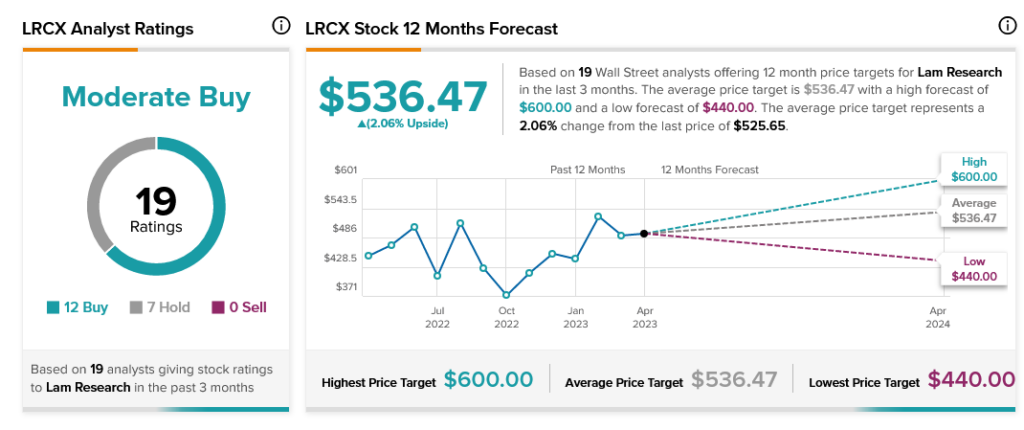

Overall, analyst consensus calls Lam Research stock a Moderate Buy with 12 Buy ratings and seven Holds. However, it only offers limited upside potential of just 2.06%.