Gold has been considered a safe haven investment in times of economic instability. Since 2022, equity markets have behaved erratically with rapidly rising inflation, consistent interest rate hikes, and poor financial performances by listed companies. As such, investors are fleeing to gold ETFs and gold futures and even investing in the physical yellow metal to save their hard-earned money. Gold ETFs have surpassed the many barriers to investing in gold commodities including buying, storing, selling, and transaction costs involved in buying the physical asset.

Today, we will look at what Gold ETFs are, how they work, and which are the best available gold ETFs.

What are Gold ETFs?

An Exchange-Traded Fund (ETF) is a financial instrument that tracks indices or a unique set of stocks in different sectors. ETFs are categorized based on various parameters, including the index they track, industry focus, commodity ETFs, currency ETFs, and so on.

As the definition goes, gold ETFs track the prices of gold, while a few invest in gold-mining companies. The performance of the ETF will fluctuate depending on the prices of gold or the performance of the gold-mining companies. Importantly, gold ETFs give investors exposure to the precious yellow metal without having to purchase it directly. Let us look at some of the top-performing gold ETFs.

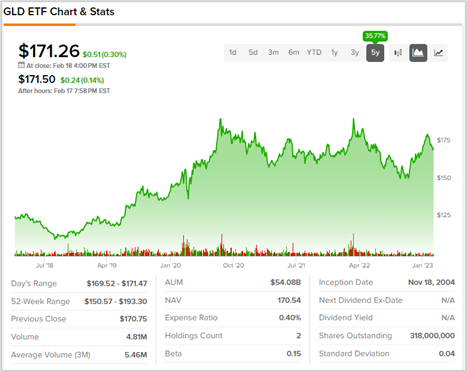

# SPDR Gold Shares (GLD)

SPDR Gold Shares is one of the oldest (founded in 2004) and the largest physical asset-backed gold ETFs in the world. The ETF tracks the spot price of gold. It trades under the ticker symbol GLD on the NYSE Arca and several other exchanges including Singapore, Hong Kong, Tokyo, and Mexico. As per the ETF’s website, “SPDR Gold Shares represent fractional, undivided beneficial ownership interests in the Trust, the sole assets of which are gold bullion, and, from time to time, cash.”

As of February 17, 2023, the fund’s assets under management (AUM) stand at $54.23 billion. GLD has an expense ratio of 0.40%.

# iShares Gold Trust (IAU)

The iShares Gold Trust was launched in January 2005, with the investment objective of tracking the performance of the price of gold. The fund trades under the ticker symbol IAU on the NYSE Arca.

As of February 17, 2023, IAU has $26.26 billion in AUM. Notably, IAU has an expense ratio of 0.25%, much lower than that of GLD.

# SPDR Gold MiniShares Trust (GLDM)

The SPDR Gold MiniShares Trust was launched in June 2018 and is a smaller version of the GLD fund. It trades under the ticker symbol GLDM on the NYSE Arca and is also traded on the Mexican Stock exchange.

As of February 17, 2023, GLDM has $5.64 billion in AUM and has one of the lowest expense ratios in the category of 0.10%.

# Aberdeen Standard Physical Gold Shares ETF (SGOL)

Aberdeen Standard Physical Gold Shares ETF was launched in September 2009 with the ticker symbol SGOL on the NYSE Arca. The fund also tracks spot prices of gold and claims to have documentation for each gold bar currently held.

As of February 17, 2023, SGOL has $2.43 billion in AUM and has an expense ratio of 0.17%.

# iShares Gold Trust Micro ETF of Benef Interest (IAUM)

iShares Gold Trust Micro ETF of Benef Interest was launched in June 2021. The fund trades under the ticker symbol IAUM on the NYSE Arca.

Remarkably, IAUM has one of the lowest expense ratios among the funds at 0.09%. As of February 17, 2023, the fund’s AUM stands at roughly $945 million.

Key Takeaways

Gold ETFs are one of the safest ways of investing in the precious yellow metal. Gold ETFs come with a host of benefits including transparency, real-time gold prices, liquidity, and tax efficiency. Investors can choose to invest in gold ETFs as a tool to hedge against macroeconomic downturns.

Keep in mind that investors best not allocate all of their holdings to gold ETFs. Rather, a prudent investor should diversify his/her portfolio into equity, bonds, ETFs, and cash as per one’s risk-reward appetite.

As always, investors can use the TipRanks ETF page to research and study their performance and make informed investment choices.