Now, brokers, banks and hedge fund managers have a new, highly useful stock research tool to offer their clients. TipRanks’ Risk Factors tool will take enterprises over the top and help them rise above the competition.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Our Risk Factors tool uses machine learning and proprietary algorithms to validate the risk factors on any stock. Brokers, banks and hedge funds can give more value to their clients by providing them with this essential stock research tool.

TipRanks’ users are always pleased about the simple way the Risk Factors presents hard-to-find data that is usually obscure and difficult to understand. At a glance, they are able to comprehend in-depth information about the risk presented by companies that are publicly traded. The Risk Factors tool facilitates and streamlines their stock research.

What are Risk Factors in Investment?

Public companies are required to disclose risks that can affect the business and impact the stock. These disclosures are known as “Risk Factors.” Companies disclose these risks in their yearly (Form 10-K), quarterly earnings (Form 10-Q), or “Foreign Private Issuer” reports (Form 20-F).

Risk factors show the challenges a company faces. Investors can consider the worst-case scenarios before making an investment. TipRanks’ Risk Analysis categorizes risks based on proprietary classification algorithms and machine learning.

Every publicly traded company has main six categories of risk that could affect its stock, and each of the six categories has four sub-categories. The main categories are as follows:

- Finance & Corporate

- Production

- Legal & Regulatory

- Macro & Political

- Tech & Innovation

- Ability to Sell

Before you invest in a stock, it’s important to know which risks the company faces.

Identifying Risk Factors of Stocks – TipRanks Makes it Easy

Companies are required to report their Risk Factors to the SEC in their quarterly and yearly reports. However, it’s difficult for investors to get value from these disclosures. They are long, tedious to read, and almost impossible to understand. That is, until now!

TipRanks has launched a new feature, enabling you to fully grasp all the possible risks entailed in each stock investment. As always, TipRanks does the hard work, so you can enjoy conducting research with ease.

Our new feature gives you an easy-to-understand overview of the risks that companies report to the SEC. We provide a Risk Overview, a breakdown according to the six main risk categories, and the number of disclosed risks.

Additionally, we clearly indicate which risks have changed for a company since its previous filing. Users can easily see the old text the company used to describe its risks, the new and updated text, and specific changes to the text.

Here’s an example of Apple’s Risk Analysis on TipRanks:

Next, you can find a handy graph that pictorially relays how the company’s risks have changed over time. Here’s another example from Apple’s Risk Analysis:

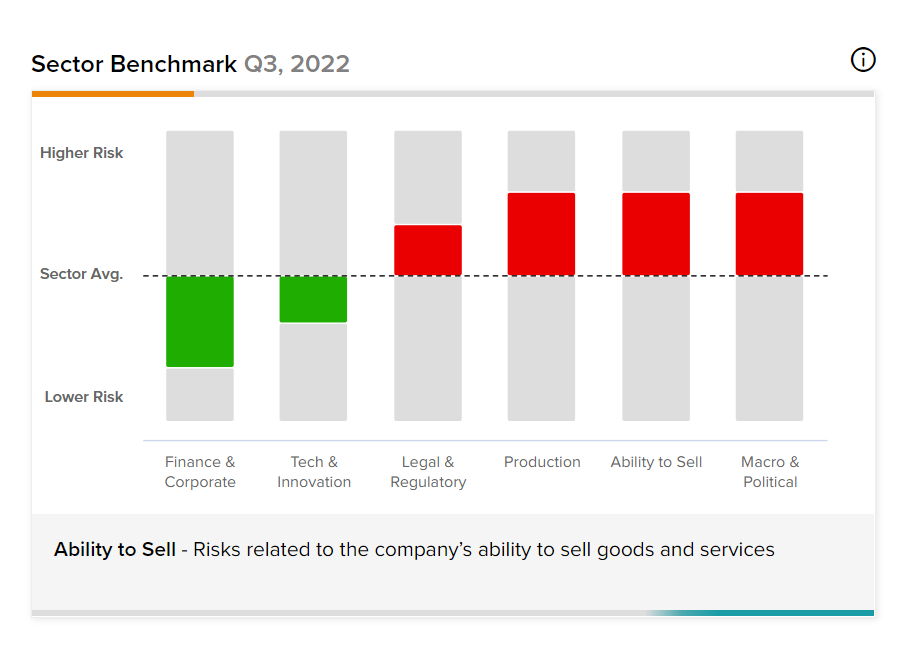

We also give a Sector Benchmark section for each stock. That feature shows users, at a glance, how the risk levels of the stock they are researching compares with the average risk levels of other companies in the same sector.

Here’s Apple’s Sector Benchmark chart:

Give it a Try!

Check out Apple’s Risk Factors>>

Check out Amazon’s Risk Factors>>

Check out Meta’s Risk Factors>>

Summary

TipRanks’ enterprise clients have a leg up on their competitors, because they give their customers access to invaluable data that is difficult to procure. TipRanks’ machine learning and proprietary algorithms break down the Risk Factors submitted in SEC reports, and present them in an easy-to-read format.

With TipRanks, brokers, hedge funds and banks have the power to give their clients superior stock research tools. Make your clients happy with access to TipRanks’ risk analysis tools.