Investors often scramble for websites while making stock investment decisions. There are numerous stock research websites out there, though not all are fully equipped to handle all the necessary research. What investors need today is a website that fully encompasses the features of both technical and fundamental research aspects. Moreover, these websites need to be technologically advanced as well as user-friendly to help even a novice investor in the stock-picking process.

To help you with the best stock website selection process, we have pinned down the top five fastest-growing stock research websites currently.

- TipRanks

- The Motley Fool

- Yahoo! Finance

- TradingView

- Zacks

Further, when comparing stock research websites, answering a few questions will help you in selecting the best one. Below are a few prerequisites for each stock website:

1. What features should I look for in a stock website?

2. Are there any free stock websites that are reliable?

3. How do I choose between different stock websites?

4. Can I trust the information provided on stock websites?

Let’s look in more detail at the five fast-growing stock websites, learn about their unique features, and see what makes them the most preferred.

1. TipRanks

TipRanks was started with the philosophy of “leveling the playing field for retail investors.” With this intent in mind, the stock analysis app has rolled out several unique features, giving individual investors the capabilities that were once available only to professional traders. Also, along with stocks from different regions, you can research exchange-traded funds (ETFs) and cryptocurrencies on the TipRanks platform.

Remarkably, TipRanks hosts a multitude of tools, including the ability to view individual analyst forecasts (Buy/Hold/Sell ratings) and 12-month price targets, technical analysis, price charts, company earnings and financials, dividend history, company-specific news, and more. The platform even offers data on the trading activity of insiders, retail investors, and hedge funds, as well as blogger opinions on stocks, website traffic analysis, risk analysis, and competitor comparisons.

Importantly, the TipRanks platform also offers options data. Another cool feature is that a user can access TipRanks’ Stock Comparison tool to compare and contrast different stocks.

What’s more, TipRanks ranks experts based on their success rate and average returns from each of their ratings. This list includes top analysts, corporate insiders, hedge fund managers, financial bloggers, and even individual investors. By doing so, users get a better view of an expert’s performance and can decide whether or not to follow their stock recommendations.

TipRanks also assigns a “Smart Score” to each stock. The score is based on eight key market factors. Stocks with a maximum score have historically outperformed the S&P 500 Index (SPX).

Further, TipRanks is the only platform that provides ETF forecasts and price Targets for individual ETFs. Finally, users can create a Smart Portfolio on TipRanks by adding their holdings of stocks, ETFs, cryptocurrencies, and mutual funds (MFs), as well as trade fractional shares. You can also import/connect your existing portfolio with a host of brokers, such as Ally, Robinhood, Fidelity, Interactive Brokers, Vanguard, E*TRADE, Charles Schwab, and more.

2. The Motley Fool

The Motley Fool’s philosophy is to “make the world smarter, happier, and richer.” The platform uses both a fundamental and technical analysis approach to recommend stocks. The Motley Fool platform provides several market research solutions to improve your stock investing process. Its investment rationale is to own at least 25 stocks and hold them for five years.

The fool.com platform’s range of services includes stock recommendations, investment research and analysis, retirement planning, and personal finance advice. The Motley Fool has several plans designed to cater to different investor appetites. Its Stock Advisor and Rule Breakers plans are most popular among users.

Under their flagship Stock Advisor plan, you get two new stock picks each month, their top 10 timely buys chosen from over 300 stocks, foundational stock recommendations for new and experienced investors, and educational materials. Plus, you get access to an investor community where you can gain insights based on the knowledge and experience of other investors. The Stock Advisor plan boasts about beating the overall market performance.

The Rule Breakers plan focuses on high-growth stocks, which, as per the platform, are poised to be the future market leaders. The stocks in this plan have also outperformed the S&P 500 since its inception.

Even under the Rule Breakers plan, you get similar two stock picks monthly, top 10 Rankings, Starter Stocks ideas, and Community and Investing resources similar to the Stock Advisor plan. The only difference is that this plan focuses only on the high-growth businesses.

Besides these well-known plans, The Motley Fool also offers specific plans under its Everlasting Stocks model, industry-specific Rule Breakers plans, and one called Rule Your Retirement, among others. Importantly, the platform also offers an Epic Bundle, which gives users immediate access to their four foundational stock-recommendation services, namely Stock Advisor, Rule Breakers, Everlasting Stocks, and Real Estate Winners.

3. Yahoo! Finance

Yahoo! Finance is one of the oldest and most widely used stock research platforms. It is considered one of the best websites for beginners and novice investors since most of its offerings are free and easy to use. The platform offers the latest company news, press releases, stock quotes, stock charts, stock screeners, top gainers/losers, data about mutual funds, exchange-traded funds (ETFs), cryptocurrencies, as well as futures and options.

Additionally, a user can create a portfolio for free as well as create a watchlist of their favorite stocks. Yahoo! Finance’s price charts are widely used to accurately track a stock’s price movement. The platform also has paid premium subscription plans under its Yahoo! Finance Plus plans, namely Yahoo! Essential and Yahoo! Finance Lite.

Through these plans, you get access to Yahoo! Finance’s specialized services, such as portfolio analytics, research reports from expert analysts, investment ideas, including bullish and bearish trade ideas, enhanced charting tools with the help of interactive charts, company insights, including exclusive alternative data sets, and Yahoo! Finance community insights.

4. TradingView

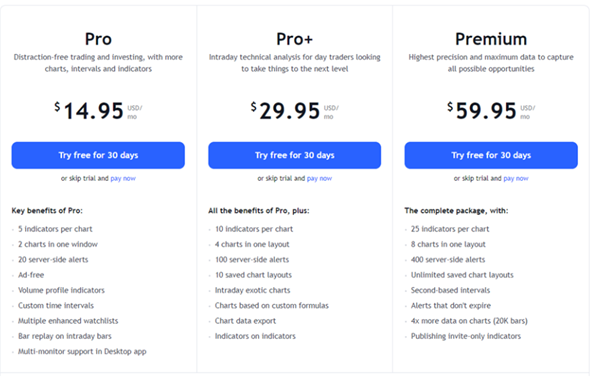

TradingView is a technical research platform for stocks, crypto, forex, futures, indices, and bonds. The platform boasts supercharged charts with hundreds of pre-built studies, 90+ intelligent drawing tools, and a set of tools for in-depth market analysis, covering the most popular trading concepts.

Additionally, TradingView provides data on financial statements, valuations, and financial ratios. In addition, there are customized analysis services available that provide key metrics like historical annual financial data on charts, technical indicators (such as volume and MACD), and backtesting, among others. TradingView has 50 million traders and investors that use its platform regularly.

Its premium services come with enhanced tools as well. For instance, custom alerts are available that make investors aware of important stock price movements.

5. Zacks

Zacks Investment Research is a comprehensive stock research website that provides investment research, stock analysis, and portfolio management services. It also has technical analysis tools for trading stocks. Zacks offers both free and subscription-based services.

Zacks puts a greater emphasis on a company’s earnings. It regularly updates the earnings estimates of listed companies and ranks them accordingly. Zacks is known for its Zacks Rank stock-rating system, which is created using its proprietary formula based on revisions in a company’s earnings estimates. The Zacks Rank determines if you should buy, hold, or sell the stock.

Its free services include market data and information about the stock market and related market and financial news. The platform includes average price targets, brokerage recommendations, earnings, and dividends.

The Zacks Premium service includes the Zacks #1 Rank List, a portfolio of long-term stocks, a premium stock screener, equity research reports, and more.

The Zacks Premium service is available at $249 per year and the Ultimate subscription costs $299 per month.

Which is the Most Trusted Stock Website?

All of the five above-mentioned stock websites have their own set of unique features. Each website strives in different ways to provide investors with the best data and analysis to make the best-informed investment decisions. However, which is the best website? After researching each stock website thoroughly, we have concluded that TipRanks has the best offerings for its customers, based on the questions we had recommended asking earlier to identify a good website.

- What features should I look for in a stock website?

While looking for a stock website, we must consider the array of services provided by the websites. The TipRanks website provides a wide variety of tools for both fundamental and technical analysis and continues creating new tools. TipRanks has also simplified its features for enhanced clarity. Its tools are user-friendly and easy to understand.

- Are there any free stock websites that are reliable?

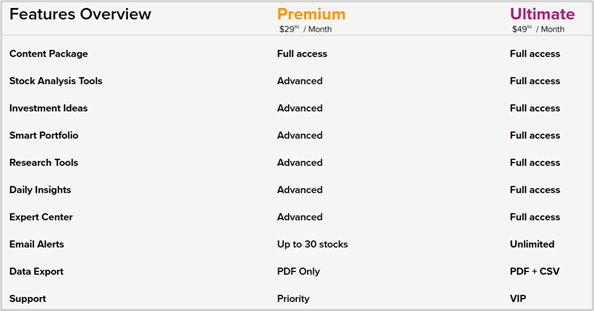

Almost all stock research websites provide at least some free data to users. Furthermore, TipRanks also has the cheapest subscription fees for its Premium and Ultimate accounts, granting full access to its features and services. All in all, TipRanks seems to be a winner among the five stock websites, giving the best value to investors.

- Can I trust the information provided on stock websites?

We can safely say that TipRanks has accurate and reliable information since it gives data based on the actual views of real experts. For instance, it provides authentic analyst recommendations and hedge fund trading activities.

- How do I choose between different stock websites?

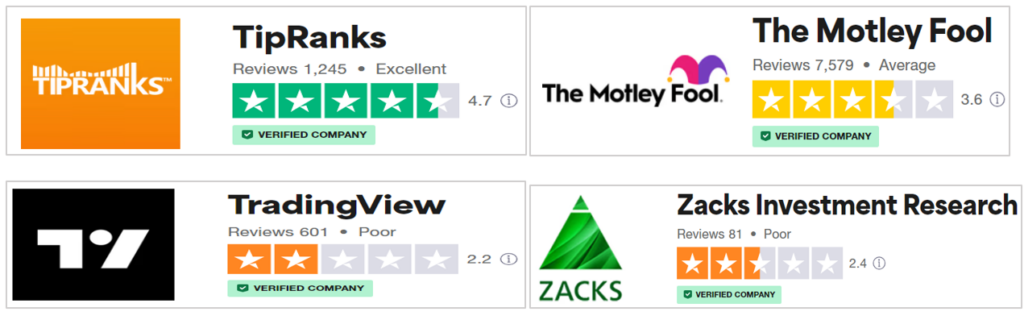

To select the best stock website from the available alternatives, you can consider the pricing, services offered, quality of research, and value for money. Importantly, you must consider the reviews of users. Essentially, TipRanks is also the platform that customers like best according to their reviews. We used the well-known review tool Trustpilot to see how the websites rank and what their reviews tell us. They agreed with our assessment.