October marked the beginning of the September quarter-ending earnings season. The results displayed the capabilities of Wall Street analysts, who had studied the companies and given their recommendations on stocks. Some of these analysts have outperformed on their stock-picking journey and earned massive returns on their calls.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

It is not surprising that a majority of the top ten analysts in the TipRanks database are experts in covering the Oil and Gas sector. The demand-supply imbalance caused by the unprecedented war has led to persistently high energy prices across the globe. As a result, most of the companies in the energy sector are registering massive profits and related stock price gains.

Let’s take a look at October’s top ten analysts on TipRanks’ Experts Center, which has exuded a high success rate on calls and generated impressive returns.

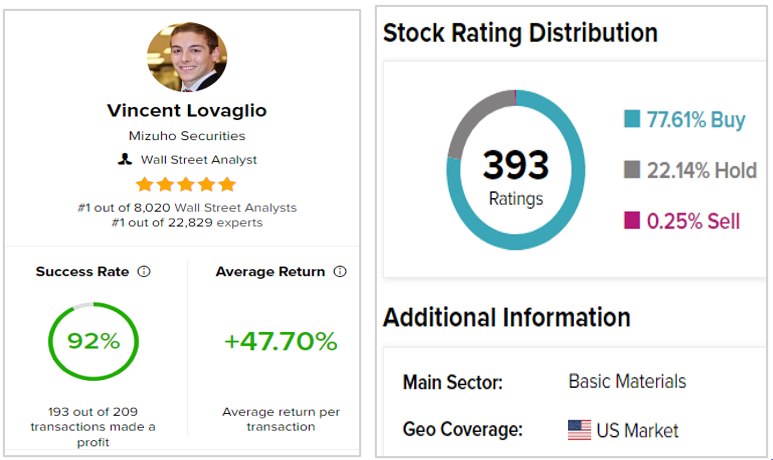

#1 Vincent Lovaglio (Mizuho Securities)

Vincent Lovaglio, an equity research analyst at Mizuho Securities, specializes in companies from the Energy sector’s Exploration and Production (E&P) businesses.

Notably, Lovaglio ranks #1 out of the 8,020 analysts tracked on TipRanks. What’s more, he takes the first spot amongst the entire universe of 22,829 experts in the TipRanks database.

The five-star analyst has an overall success rate of 92% and has generated an average return per transaction of 47.70% during the past year.

To date, his best rating has been on Comstock Resources (NYSE:CRK), a Texas-based oil and natural gas company. Lovaglio generated a massive 269.80% return on his Buy recommendation on CRK stock between April 20, 2021, and April 20, 2022.

#2 Dan Payne (National Bank)

Next up is Dan Payne, Managing Director of the National Bank. Payne is an expert in covering Basic Materials companies from both the U.S. and Canadian markets. Payne ranks #2 on the TipRanks analyst’s list and #3 among the overall Experts in the TipRanks database.

Notably, Payne boasts an overall success rate of 82% and has generated an average return per transaction of an impressive 72.20% during the past year.

To date, the five-star analyst’s best rating has been a Buy call on Canadian-based Birchcliff Energy (OTCMKTS:BIREF). Payne generated a humongous 372.70% return on BIREF stock between the period October 6, 2020, to October 6, 2021.

#3 John Freeman (Raymond James)

John Freeman, Managing Director of Raymond James, heads the Exploration and Production (E&P) sector and the firm’s commodity research. The five-star analyst ranks #3 on the TipRanks analyst’s list and #4 amongst the overall Experts.

Remarkably, Freeman has an overall success rate of 71%. Through his calls, Freeman has generated an average return per call of 42.10% during the past year.

The analyst generated a gigantic 738.10% return on his Buy call on hydrocarbon exploration company, Laredo Petroleum (NYSE:LPI) between the period October 23, 2020, to October 23, 2021.

#4 Travis Wood (National Bank)

Next up is analyst Travis Wood of National Bank, who specializes in U.S.-based companies in the Energy Sector. Wood ranks fourth and ninth on the TipRanks’ analysts’ list and overall Experts’ list respectively.

Notably, Wood enjoys an overall success rate of 92% and has generated an average return per call of 56.10% during the past year.

To date, Wood’s best rating has been for hydrocarbon exploration and production company Ovintiv Inc. (NYSE:OVV). The analyst generated an impressive 328.30% return on his Buy call on OVV stock between the period October 16, 2020, to October 16, 2021.

#5 Colin Rusch (Oppenheimer)

Colin Rusch is the Managing Director, Senior Research Analyst, and Head of Oppenheimer and Co’s Sustainable Growth & Resource Optimization franchise. Rusch bags the fifth position on the TipRanks analyst’s list.

The five-star analyst has a 56% overall success rate. Through his calls, Rusch has generated an average return per transaction of 54.00% in the past year.

To date, Rusch’s best call has been on Canada-based Westport Fuel Systems (NASDAQ:WPRT). The company engages in the engineering, manufacture, and supply of alternative fuel systems and components. His Buy call on WPRT between March 18, 2020, to March 18, 2021, generated a humongous 800% return.

#6 Nitin Kumar (Mizuho Securities)

Number 6 on our list is Nitin Kumar, a senior research analyst, who recently joined Mizuho Securities from the famed Wells Fargo Securities firm. Kumar is an expert in tracking the U.S. oil and gas sector.

The analyst boasts a success rate of 91% and has generated a 51.20% average return per call in the past year.

Kumar’s Buy call on Antero Resources Corp. (NYSE:AR) has earned him a massive 245.50% return during the period August 23, 2021, to August 23, 2022.

#7 Leo Mariani (MKM Partners)

Leo Mariani is the Managing Director and Senior Energy analyst at MKM Partners. Mariani ranks #7 on the TipRanks analyst’s list. The five-star analyst enjoys an overall 68% success rate. Also, his calls have earned an average return per transaction of 35.70% in the past year.

Notably, Mariani earned a massive 800% return on his Buy call on Permian Resources Corp. (NYSE:PR) between the period October 20, 2020, to October 20, 2021.

#8 Quinn Bolton (Needham)

Next up at #8 is Quinn Bolton from Needham & Co. Bolton is a CFA holder and specializes in U.S.-based communication integrated circuits (ICs) and consumer semiconductor companies (technology sector).

Bolton has an overall success rate of 62% and generated a 34.10% average return per rating in the past year.

Bolton’s Buy call on Acm Research (NASDAQ:ACMR) earned him a 608.40% return between the period August 19, 2019, to August 19, 2020. ACMR engages in the development, manufacture, and sale of single-wafer wet cleaning equipment.

#9 Scott Hanold (RBC Capital Markets)

Scott Hanold, Managing Director of Energy Research at RBC Capital Markets, ranks #9 on TipRanks’s list of analysts. Hanold scores an overall success rate of 68%. The five-star analyst has generated an average return per call of 32.20% in the past year.

To date, Hanold’s best rating has been a Buy call on the oil and gas company, Matador Resources (NYSE:MTDR). The analyst generated an impressive 389.10% return on MTDR stock between the period October 01, 2020, to October 01, 2021.

#10 Garrett Ursu (Cormark Securities)

And finally, on #10, we have analyst Garrett Ursu of Cormark Securities. Ursu conducts institutional equity research for both U.S. and Canada-based oil and gas companies.

Ursu boasts an overall success rate of 86% and has generated a massive 170.10% average return per transaction through his calls in the past year.

Notably, his best call to date has been on Journey Energy Inc. (OTCMKTS:JRNGF). Through his Buy call on JRNGF stock between September 30, 2020, to September 30, 2021, Ursu earned a humongous 766.10% return.

Ending Thoughts

As seen from the above list, our top ten analysts for October have each generated massive returns on their stock views. Moreover, each analyst has a superb success rate. Investors may choose to follow the views of top analysts to make informed investment decisions. Notably, TipRanks accumulates the recommendations of several Top Experts, which can be considered while making investment choices to maximize returns. We will come back soon with the top ten analysts’ picks for November.