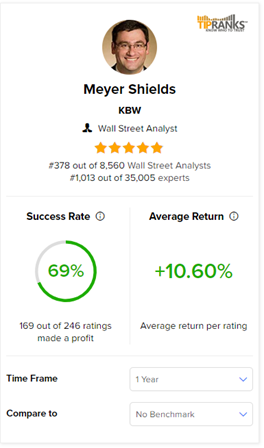

We had the privilege of meeting with KBW analyst Meyer Shields on our TipRanks podcast, Tip Talk with TipRanks. This five-star analyst is one to watch: he ranks 378 out of the 8,560 Wall Street Analysts that TipRanks covers. Over the past year, Shields has had a success rate of 69%, and has generated average returns of 10.60% on his ratings.

Shields holds a degree in actuarial science from the University of Toronto. With over 23 years of experience in analyzing stocks, he specializes in the Insurance sector, particularly the Property & Casualty (P&C) Insurance sub-sector. The analyst covers stocks listed in the U.S. and the Canadian markets. Shields also covers insurance brokers, personal insurers, reinsurers, and commercial reinsurers.

Shields on the Insurance Sector

During the interview, Shields shared many interesting and thoughtful insights into this often-overlooked industry.

According to Shields, some of the most important factors to consider before investing in insurance stocks are how quickly an insurance company can grow, and how much profit it makes on every dollar of commissions/fees.

He also explained that that the plethora of information that an insurance company has is the lifeline for the insurance industry. It’s the basis on which companies decide on the charges or premiums to be charged to customers.

Ironically, Shields noted, anything bad that happens in the world is connected to the insurance sector. Although the sector’s survival depends on negative connotations, the fact is that the sector “helps people recover from bad experiences,” he added.

Further, talking about the Insurance sector in general, Shields said that in its entirety, the sector remains a little bit behind in terms of technological advancements. Even so, several tech-focused progressive companies are leaders in technology usage.

We also asked Shields about what creates the “moat” for insurance companies. He believes that the vast amount of datasets, although not perfect, is the real moat for the companies. Notably, insurance companies have access to reams of financial metric data with them, which enables them to effectively calculate pricing trends, inflation trends, recurring claims, and so on.

Furthermore, the geographical location, lines of business (subsegments), company management, and the strategy followed are some of the primary drivers for insurance companies’ profits.

What is the Future of the Insurance Industry?

We asked Shields whether the Insurance industry will yield good returns this year, or whether the industry takes a long-term investment horizon. Shields’ response is elucidating for investors who are considering insurance investments.

The five-star analyst believes that both car insurance companies and reinsurers are poised to do well this year and next. Car insurance companies have had a tumultuous ride during the pandemic and the years following; however, this year the sector is poised to perform well. As for reinsurers, these companies are expected to adopt appropriate pricing levels in renewals on January 1, 2024, making them a good subsegment to invest in.

Regarding the uncertain macroeconomic environment, insurance is largely independent of macro trends, Shields added. Currently, the Insurance sector is behaving better for longer, and insurance companies are earning positive investment income, mostly from their bond investments. Specifically, Shield says that an investor can be bullish if he/she focuses on the P&C insurance sub-sector in the uncertain macro environment.

With this background in mind, let’s look at three insurance companies and Shields’ views on them.

Brown & Brown (NYSE:BRO) – Hold Rating

Brown & Brown is an insurance broker with an expanding international footprint. Shields has set a price target of $76 on BRO stock, implying 6.9% upside potential from current levels. His Hold view on the stock stems from the premise that inflation is expected to go down steadily over the coming months and the next year.

Inflation is correlated with insurance companies’ growth, in that during a high inflation scenario, companies can charge higher premiums. Also, the rate of insurance premiums has risen steadily over the past few quarters, acting as a tailwind. Now, however, with the possibility of inflation coming down, premiums will likely be reduced, going forward. Hence, Shields is a little bit less optimistic about the outlook for the Broker segment, compared to other sub-segments.

Allstate (NYSE:ALL) – Buy Rating

Allstate offers P&C insurance and specializes in car insurance products. Shields believes that auto underwriting rates in Q3 of this year should come in better, compared to last year. This shows promising prospects for Allstate going forward and hence, the analyst has a Buy rating for the stock.

Shields has a Buy rating and a price target of $148 on ALL stock, implying 30.7% upside potential from current levels.

American Insurance Group (NYSE:AIG) – Buy Rating

Shields believes that AIG poses the best opportunity for insurance investors, currently. Although AIG was an underperformer a few years back, a better management strategy and improved execution have made the stock a winner. The company has shown tremendous progress in the P&C and Life insurance segments. Moreover, it has simplified its operations and streamlined costs, making it one of the best stocks to invest in, as per the analyst.

Shields has a Buy rating on AIG stock with a price target of $75, implying 22.4% upside potential from current levels.

Ending Thoughts

Shields, with his substantial knowledge and experience in tracking the Insurance sector, has shown considerable success in his stock ratings. He is optimistic about the Insurance industry, which has been behaving responsibly and with discipline lately.

Thus, with appropriate due diligence, investors who want to follow the top Wall Street analysts can consider investing in the Insurance sector.