TipRanks is the only platform that gives you access to the website trends of publicly traded companies for the unreported quarter.

Institutional investors, such as hedge fund managers, enjoy access to insights that the average investor can only dream of. Massive budgets buy them exclusive data that indicate how companies are performing, without having to wait for earnings reports. A powerful example of the sort of data they use is identifying changing trends in online consumer behavior. In other words, they use the data to figure out whether website traffic to publicly traded companies is increasing or decreasing.

Imagine if you could discover whether a company was experiencing an upward trend in website visits. This could indicate that a strong report is about to be announced. On the other hand, if you learned there was a drop in website visits, you might predict the opposite. And while growth in online usage doesn’t guarantee excessive sales, this data is another example of how institutional investors have an unfair advantage.

TipRanks levels the playing field by making data about website trends accessible to all investors. We partnered with Semrush, which generates the most accurate estimation of website traffic, to give you the same research power as the biggest asset managers. TipRanks is the only platform that provides this data to retail investors. What’s more, it’s free!

With earnings season kicking off, here’s how you can implement website traffic data into your investment strategy.

Potential to Outsmart the Market

It’s worth understanding the potential of this data. Here are two recent examples of website trends correlating with earnings.

In Q4 2021, the number of estimated visits to Sofi’s (NASDAQ: SOFI) website increased by over 60%, quarter-over-quarter. On March 1, 2022, the company released its earnings report for that quarter. The company beat analysts’ forecasts. The next day, SOFI stock ended the day with a 3.4% gain.

On the other hand, in Q3 in 2021, traffic to Robinhood (NASDAQ: HOOD) decreased by over 40.72% quarter-over-quarter. On January 27, the company missed its earnings forecasts, and the stock plunged by 12% during after-hours trading. However, the drop was short-lived and unlike its previous two reports that also missed forecasts, the next day the stock increased by over 9%.

Interested to learn more about the potential correlation between website visits and earnings? Read our Coinbase case study.

How to Incorporate Website Visits into Your Research

To access this data, you need to begin by researching a stock. Enter the stock name or ticker on the search bar on TipRanks, and you will be brought to the Stock Forecast page for that stock. Look at the column menu along the left side of the page, and click on Website Traffic.

Website Traffic Trends

You will be taken to a dedicated page where you can research website traffic trends. The tool enables you to select one or several domains, compare traffic over different periods, and differentiate between the total number of estimated visits and visitors, among its filtering options.

For some websites, the volume of visits is more likely to be relevant. Social media platforms such as Pinterest and Coinbase are an example.

For others, the number of unique visitors is more likely to impact revenue. Companies in the travel sector such as airlines, from which most people don’t make purchases daily, are an example.

You can look at quarterly or monthly results (turquoise line), compare them to the same period last year (grey line), as well as see the stock price (orange line). Hover over the chart to reveal the relevant statistics.

It’s worth paying attention to the unreported period.

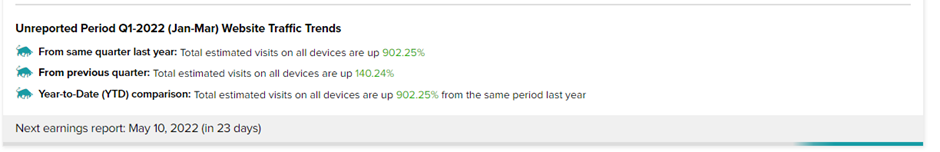

Below the chart, you will see an overview of stats regarding the unreported period, including when the next earnings report is scheduled.

Growth Overview

Scroll down the page to see how the company’s domains have grown since the same period last year or the previous quarter, set simply and visually. You can compare it to the same period last year, or to the previous period. You have the same filter options as the chart above.

In this case, ahead of Sofi’s earnings release on May 10, we see that globally, the total number of estimated visits to the sofi.com domain on all devices, compared to the previous period is:

Monthly growth (March 2022 compared to February 2022) increased by 4.56%

Quarter-to-date growth (Q1 2022 compared to Q4 2021), increased by 140.24%

Year-to-date growth (YTD 2022 compared to YTD 2021), increased by 902.5%

It is worth remembering that a lot of factors contribute to a stock’s price following an earning report, and website traffic is only one of them. Other factors include management outlook, a dividend policy announcement, or a change in growth estimates.

Website traffic trends are also only one part of your stock research on TipRanks, where you can easily access analyst forecasts, insider and hedge fund transactions, stock analysis, and more.

Now, Give it a Try!

With earnings season starting, now is the perfect time to research website trends. Use our earnings calendar to see which companies are scheduled to report, alongside essential data, ahead of their release.