For many people, the idea of investing in stocks could be daunting. It could seem like something only rich people can do with the help of a financial planner, or an activity that takes a lot of effort to get started. But the truth is, anyone can invest their money, with proper research and planning.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

For investing newbies, platforms like TipRanks can guide potential investors with their wide variety of research tools. The Stock Screener, Smart Score Stocks, and Top Analysts Stocks are just a few of the many tools that can be used to pick the right stock at the right time.

Keeping your money idle in your savings account is the worst thing to do. Our money should always be generating more money!

Investing money in the stock market is a great way to do so. It allows us to become a shareholder of a company by purchasing stocks and earning dividends as an additional regular income stream. Later on, when the timing is right, we can sell the stocks at a higher price and generate returns on the money invested.

How to Start Investing in Stocks

1. Defining Goals and Budget

As a quote says, ‘A good start is half the battle’.

When it comes to stock investments, having a clear set of goals not only motivates you but also serves as the foundation for the entire process. A goal-based approach to wealth creation makes it simple to select the appropriate investment products while keeping risk tolerance and time frame in mind. The investments are classified as short-term or long-term depending on the time frame.

If an investor has a high appetite for risk and doesn’t want to keep their money tied up for a longer time, then short-term investing is a good option. On the other hand, in long-term investing, investors hold the shares for multiple years. This type of investing is the best as it helps you navigate the risks and increase the potential results.

Based on your goals, it is also important to determine a budget to start with. The best part about stock investing is that you can start small and gradually increase your holdings over time.

2. Investment Process

There are three main ways to start investing in the stock market.

- Primary Market

Firstly, an investor can directly enter the primary market by investing in a company’s initial public offering (IPO). An IPO is the process of raising funds from the public by selling a company’s shares for the first time. The price of the shares is predetermined by the company at the time of issue.

Never miss an upcoming IPO, with TipRanks’ IPO Calendar.

- Secondary Market

Another way to deal in shares is to buy and sell them in the secondary market on stock exchanges like Nasdaq, NYSE, LSE, TSX, SGX, and more. Here, all the dealings occur among the investors and not with the issuing company. In secondary markets, the prices of shares are determined by the simple rule of demand and supply.

- Mutual Funds

If you want the benefits of long-term growth from investing in stocks but also don’t have the time or expertise on the matter, then mutual funds could come to your rescue. Mutual funds are a type of investment that allow you to pool your money with other investors and then have a professional manager invest it for you.

There are many different types of mutual funds available on the market, and you can choose one based on your risk appetite, budget, and time frame. One of the biggest advantages of mutual funds is that they offer diversification. When you invest in a mutual fund, you are investing in a basket of different securities, which helps spread out your risk. Another advantage of mutual funds is that they are relatively easy to understand and purchase.

3. Picking the Right Stocks

This is the most important step in stock investing and kind of makes the whole difference. Stock picking involves deciding on the sectors or industries to invest in, comparing the stocks, landing on the right ones, deciding on the right time to buy and sell, and choosing between dividend income and price appreciation. The goal is to have a perfect balance of all types of stocks, to diversify your portfolio for maximum returns.

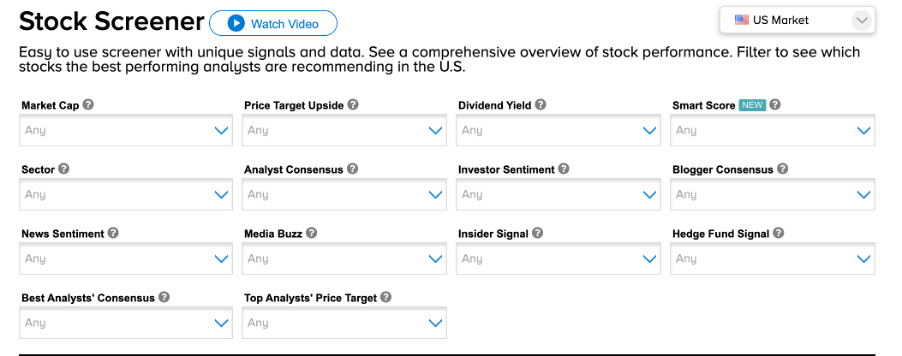

With so much information available about stocks, it is very important to trust the right sources and make an informed decision. TipRanks has compiled its data and developed various tools that will help an investor make the right decision. For example, you can use our Stock Screener to compare stocks on a variety of parameters.

Another example is TipRanks’ Top Analyst Stocks tool. Use it to find out which stocks have a Strong Buy rating consensus, according to the best-performing analysts.

4. Identifying the Risks

Investing in stocks is a great way to grow your wealth over time, but it does come with some risks. Before you invest, it’s important to do your research and understand the potential risks involved. Stock movements are dependent on a variety of factors and can sometimes lead to huge losses as well. Once you’re ready to start investing, there are a few things you should keep in mind:

- Stock investing cannot be successful without thorough research. It is very important to stay updated on the recent developments of the companies as well as the overall economy. The TipRanks news section provides all the latest news for listed companies and also its effect on their share prices.

- Diversifying your investments is very important. Don’t put all your eggs in one basket. When you diversify, you spread out your risk and increase your chances of seeing returns on your investment.

- Always start with small investments if you are investing for the first time. It is best to start small and gradually increase your investment amount as you become more comfortable with the process.

- Rome wasn’t built in a day, and neither are successful investment portfolios. It takes time to see results from investing, and being patient is the key.

- The TipRanks’ Risk Analysis tool could be a great help for investors in analyzing all the risks affecting a company and its share price. This tool, which is available for every stock, classifies all the company’s reported risks into different categories and shows a real picture to investors.

Ending Thoughts

Successful investing is all about multiplying your wealth over time. In terms of long-term potential growth, my vote goes to investing in stocks, which is the most common type of investment.

The process might look complicated to beginners, but having the right tools, expert advice, and up-to-date market news could generate good returns on your portfolio. It is equally important to be aware of your goals and your investment perspective before you enter the stock market.

Whether you have a little or a lot to invest, there is no excuse not to get started today!