Hedge funds across the globe scored remarkable profits in 2023. As per LCH Investments, a fund-of-funds firm, the top 20 hedge funds generated $67 billion of profits in 2023, higher than the 2021 figure of $65 billion.

According to LCH, Citadel topped the list of the top 20 hedge funds, with net gains totaling $74 billion. Following closely were D.E. Shaw and Millennium, both securing profits amounting to $56.1 billion each.

Top 3 Hedge Funds Ranked by LCH

Leading the pack in 2023 was Christopher Anthony Hohn’s TCI Fund Management Ltd, earning $12.9 billion in profits. Hohn has a Sharpe ratio of negative 0.29. Note that a Sharpe ratio greater than one means that the portfolio has higher returns than risks.

Securing the second position is Ken Griffin’s Citadel, with $8.1 billion in profits. A Financial Times report highlighted that, based on regulatory filings, TCI’s largest holdings as of September 2023 were Alphabet (GOOGL), Canadian National Railway (CNI), Visa (V), General Electric (GE), and rating agency Moody’s (MCO).

Meanwhile, the third spot belonged to Andreas Halvorsen’s Viking Global Investors LP, with a $6 billion profit earned in 2023. Halvorsen has a Sharpe ratio of 1.57.

TipRanks’ Top 3 Hedge Fund Managers

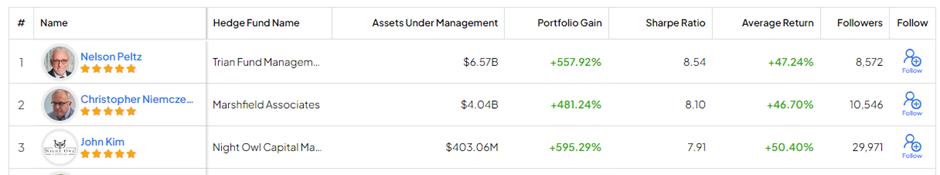

TipRanks has a unique proprietary method for rating hedge fund managers. A hedge fund’s performance is dependent on the hedge fund manager’s stock-picking prowess and investments. Hence, TipRanks rates managers based on their portfolio gain, Sharpe ratio, and average returns earned in the period.

Investors can leverage the TipRanks Hedge Fund Managers page to discover and learn about hedge fund managers, their investments, and their performances. Let’s look at the top three hedge funds as of today, based on TipRanks’ Star Ranking System: