TipRanks has identified four leading SPX ETFs for investors to consider while making investments. Which S&P 500 ETF is best to buy?

The S&P 500 index (SPX) serves as an apt benchmark for understanding the U.S. economy as it includes 500 large-cap companies listed on the U.S. stock exchanges. And rightly so, it is also one of the most followed indices.

An Exchange-Traded Fund (ETF) is a financial instrument that tracks indices or a unique set of stocks in different sectors. ETFs are categorized based on various parameters, including the index they track, industry focus, commodity ETFs, currency ETFs, and so on.

An ETF tracking the S&P 500 index is called an SPX ETF. It falls under the passive investing style and will generate returns that are almost similar to the index’s returns.

Given that it’s the most widely followed and well-diversified index, several ETFs track the SPX. The S&P 500 index’s top five holdings include technology giants Apple (NASDAQ:AAPL), Microsoft Corp. (NASDAQ:MSFT), Amazon.com (NASDAQ:AMZN), Alphabet Class A (NASDAQ:GOOGL), and Berkshire Hathaway Class B (NYSE:BRK.B). The SPX index is heavily focused on the Information Technology sector (27.23%), followed by Healthcare (14.52%), and Financials (11.65%).

Here are the four leading SPX ETFs for investors to consider investing in:

- SPDR S&P 500 ETF Trust (SPY)

- iShares Core S&P 500 ETF (IVV)

- Vanguard S&P 500 ETF (VOO)

- SPDR Portfolio S&P 500 ETF (SPLG)

All these ETFs have one thing in common, which is tracking the SPX. However, these ETFs have different Expense Ratios, Returns, and Yields that can form the basis for an investment decision. Let us look at each of the ETFs in detail and their differences.

SPDR S&P 500 ETF Trust (SPY)

The SPDR S&P 500 ETF Trust was launched by State Street Global Advisors in January 1993 and is the oldest and largest SPX-tracking ETF, to date. The ETF trades under the ticker symbol “SPY” and is listed on the NYSE ARCA Exchange.

As of February 13, 2023, SPY has $379.37 billion in assets under management (AUM) and boasts a net asset value (NAV) of $408.03. SPY’s gross expense ratio amounts to 0.095%, one of the highest among SPX ETFs but it also boasts the highest trading volumes, making it one of the most liquid funds. Further, the ETF has had a Fund Distribution Yield of 1.55% over the past 12 months.

iShares Core S&P 500 ETF (IVV)

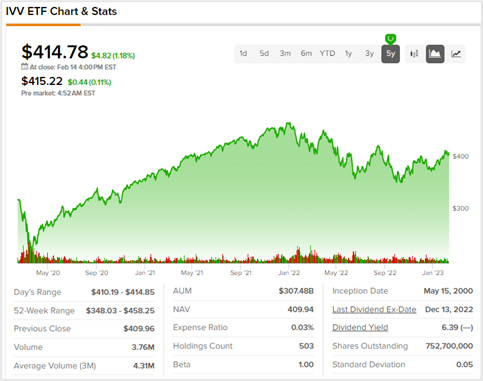

The iShares Core S&P 500 ETF was launched by Blackrock (NYSE:BLK) in May 2000. The ETF trades under the ticker symbol IVV on the NYSE ARCA Exchange.

Importantly, the IVV ETF has an expense ratio of 0.03%, significantly lower than that of the SPY ETF. As of February 13, 2023, IVV has an AUM of $311.83 billion and a NAV of $414.69. Also, the ETF has a 12-month trailing (TTM) yield of 1.57%. However, its trading volumes (liquidity) are relatively lower than those of SPY.

Vanguard S&P 500 ETF (VOO)

The Vanguard S&P 500 ETF was established in September 2010. The ETF trades under the ticker symbol VOO on the NYSE ARCA exchange.

Similar to IVV, VOO also has a low expense ratio of 0.03%. As of February 10, 2023, VOO has an AUM of $282.26 billion and a NAV of $379.31. Plus, its liquidity is comparatively lower than that of the prior two ETFs.

SPDR Portfolio S&P 500 ETF (SPLG)

Next up is State Street Global Advisors’ SPDR Portfolio S&P 500 ETF. The fund was launched in November 2005 and trades under the ticker symbol SPLG on the NYSE ARCA exchange.

Similar to the previous two ETFs, SPLG also has a low expense ratio of 0.03%. As of February 13, 2023, the fund’s AUM stands at $16.27 billion and its NAV is $48.53. Moreover, the ETF has had a Fund Distribution Yield of 1.59% over the past 12 months. SPLG, too, has weaker trading volumes compared to the SPY ETF.

Ending Thoughts

Investing in SPX-tracking ETFs like the ones mentioned above enables you to get much-needed diversification coupled with other benefits including lower costs, higher liquidity, flexibility, transparency, and tax efficiency. Investors can choose any of the leading SPX ETFs to realize the best returns on their investments. Having said that, factors such as a fund’s expense ratio, trading volume, and returns should be compared before making an investment decision.

Investors can use the TipRanks ETF page to research and study their performances and make informed investment choices.