Best Stock Research Websites of 2023

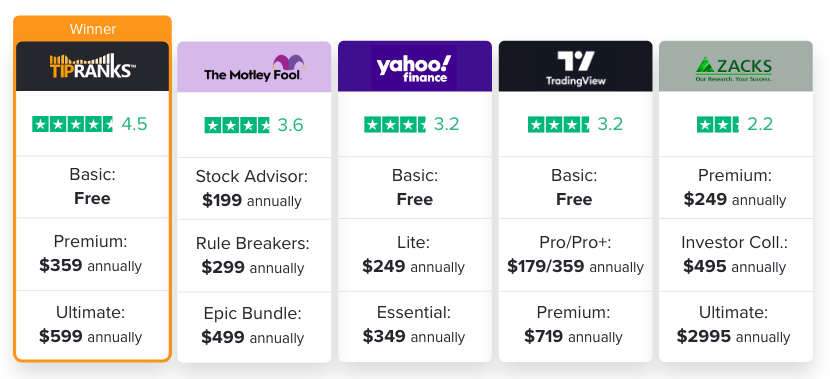

We identified five leading stock research websites:

1. TipRanks

2. The Motley Fool

3. Yahoo Finance

4. Trading View

5. Zacks

Why Is Choosing the Right Investment Research Website Important?

Stock market research websites provide access to the latest information on the stock markets. However, that’s not all. They also enable you to research which individual stocks to invest in. That’s why it is essential that you choose a platform that you can rely on for your stock research and analysis.

We evaluated the pros and cons of the five best stock research websites to see which offers the best service. This information can help you choose the right platform to make informed, profitable decisions.

Comparing Stock Research Tools

To find out which platform is most likely to help you make the best investment decisions we asked the following questions.

–Where can you find the most comprehensive, accurate, and reliable data?

–Which stock research website provides all the tools and analysis an investor needs?

–Which stock analysis tools are the most easy-to-use and user-friendly?

–Where will you get the best value for money?

–What do users of the stock research websites think?

Which is the Best Stock Research Site?

These are the best stock research websites with the most reliable data and accurate analysis.

1. TipRanks

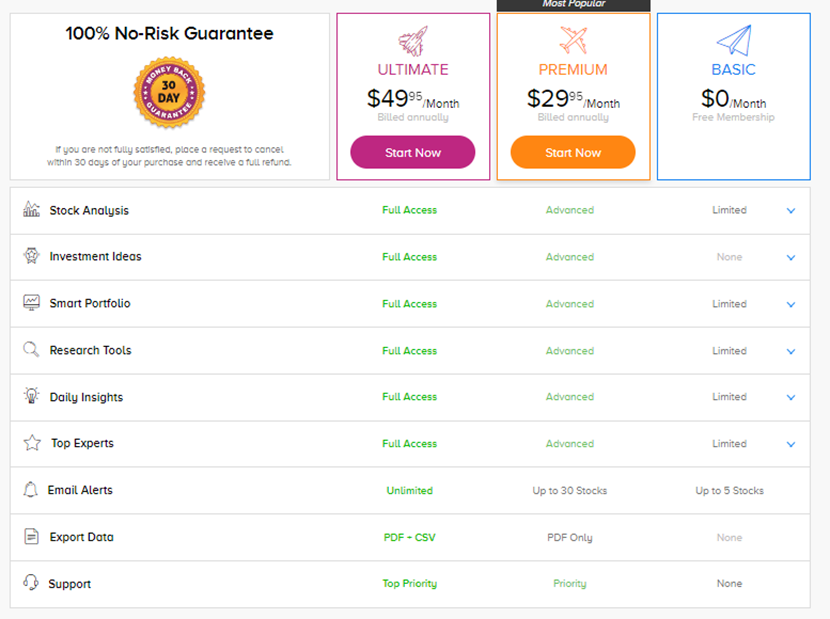

TipRanks’ stock analysis and market research tools offer institutional-level data simplified for individual investors.

The platform is unique in that it presents the ratings and price targets of individual analysts. Most of its peers only give out brokerage recommendations and price targets. This sort of transparency gives investors the ability to follow the best experts. TipRanks also presents how individual analysts rank based on their performance track records. You can even see how they perform for the individual stocks they cover.

TipRanks’ also ranks other experts. This gives you access to the top corporate insiders, hedge fund managers, financial bloggers, and even individual investors.

The platform offers a wide variety of tools. This includes tools that help investors find new ideas. For example, their easy-to-use stock screener enables investors to search for stocks according to different criteria, including unique TipRanks data.

TipRanks also enables a full stock analysis, including alternative datasets such as analyst consensus, news sentiment, website traffic, risk analysis, and financial blogger recommendations. Additionally, TipRanks assigns a “Smart Score” to each stock. The score is based on eight key market factors. Stocks with a maximum score have historically outperformed the S&P 500.

Its Smart Portfolio tool incorporates all of its data to give investors a full analysis of their holdings. Additionally, the site provides stock news and has a streaming service.

What’s more reassuring is that their data is trusted by “over 50 leading financial institutions”, as per the TipRanks website. Its Smart Portfolio tool is used by Nasdaq on its platform.

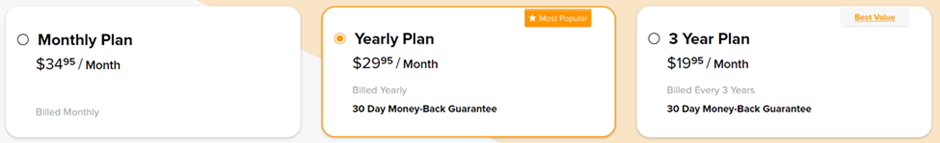

It also offers flexible subscription models, including monthly payment, or its best value 3-year plan, which includes one free year.

2. The Motley Fool

The Motley Fool wants to “make the world smarter, happier and richer.” It offers a range of market research solutions to improve investors’ decision-making process. The platform uses both a fundamental and technical analysis approach to recommend stocks.

It provides a free, as well as paid premium service to investors globally. Its paid premium membership services include stock recommendations, company analysis, model portfolios, live streaming videos, free market news, etc.

Motley Fool has two popular services: Stock Advisor and Rule Breakers which provide opinions, investment newsletters, and stock recommendations.

Its Stock Advisor gives out stock picking ideas expected to beat the overall market performance. It also provides add-on research and data to support recommendations.

The service gives out Starter Stocks recommendations for new as well as seasoned investors. It also gives two new stock picks and recommendations every month. Additionally, it also offers investors access to the investor community. This offers insights based on the knowledge and experience of other investors.

Its Rule Breakers service lays more emphasis on high-growth stocks that are set to outperform the market in future years. While the high-growth stocks promise higher returns, they come with their own set of risks. This can mean that they tend to be very volatile, especially in difficult macroeconomic conditions.

Further, not every high-growth stock recommended provides positive returns with many of them landing in the negative return territory.

Although first-time subscribers get attractive discounts, their renewal prices tend to get expensive.

3. Yahoo! Finance

Yahoo! Finance is one of the best free investment websites available at present. It offers the latest company news, press releases, stock quotes, stock charts, stock screeners, top gainers and losers, information and data about mutual funds, exchange-traded funds (ETFs), cryptocurrencies as well as futures and options.

It is a great option for beginners and novice investors who get access to free information about any particular stock, mutual fund, or ETFs.

On Yahoo! Finance, an investor can create a portfolio and add or remove stocks from their personal watchlist. The price charts also come in handy giving an indication of the stock price movements over various different time periods.

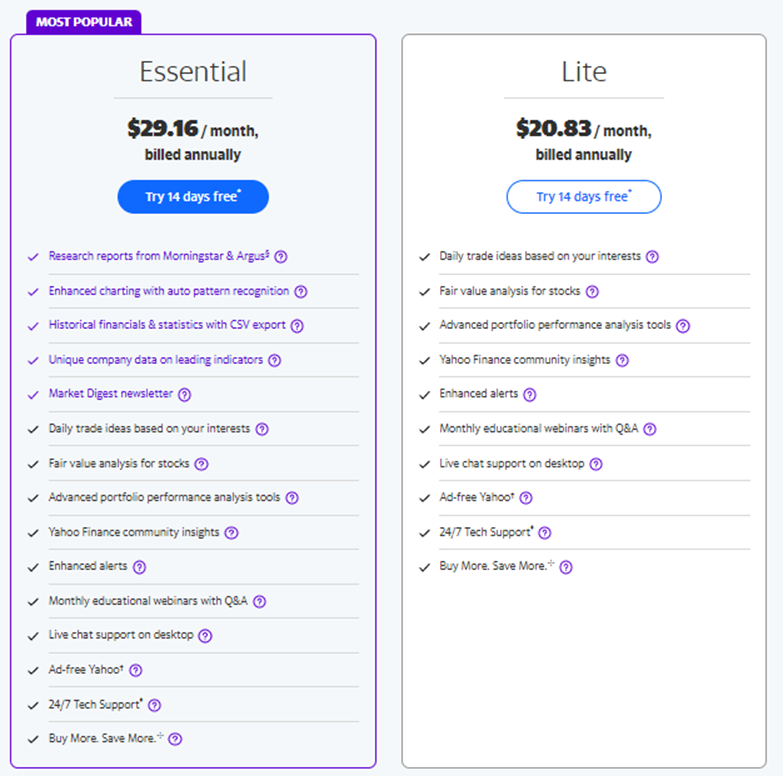

Though Yahoo! Finance is better known for its wide variety of free products, it does have a paid subscription service. Yahoo! Finance Plus Plans are available for a fee and come under two different plans: Yahoo! Essential and Yahoo! Finance Lite.

Yahoo! Essential comes at a price of $29.16 per month. It offers research reports from Morningstar & Argus, a market digest newsletter, daily trading ideas, fair value analysis tools, portfolio tracking, alerts, and community insights, among other services. Yahoo! Lite is priced at $20.83 per month and also provides a range of similar services.

Yahoo! Finance is well-reckoned for basic information on stocks. However, it lacks in-depth analysis and various datasets and tools a current-generation investor would need to know more about their stock investments.

4. Trading View

TradingView is an investment research software that is based on technical analysis and is frequently used by stock traders for their day-to-day trading requirements.

The stock application provides stock charts with real-time data across numerous exchanges. It also includes specific indicators like relative strength index (RSI), Moving Averages, Bollinger Bands, etc.

In addition, there are customized technical analysis services available that provide key metrics like historical annual financial data on charts, volume indicators, Moving average convergence divergence (MACD), backtesting, et al.

TradingView offers basic services for free under its free plan. Under its paid plans, traders can choose from various options ranging from $14.95 to $59.95.

It offers real-time market data and also provides options to create charts, track stock portfolios and share technical charts and insights with the trading groups.

Its premium services come with enhanced tools. Alerts are attached with the stock trading tools that make investors aware of important stock price movements.

5. Zacks

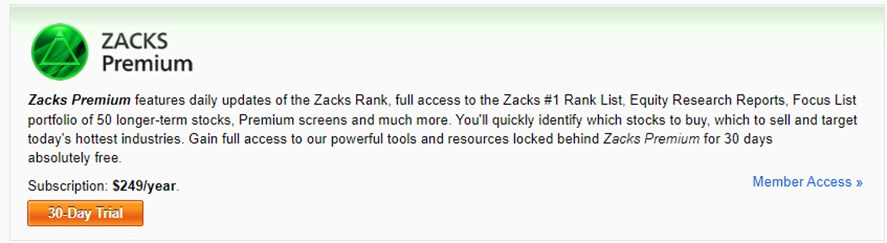

Zacks Investment Research (or Zacks) provides a comprehensive stock analysis for a subscription-based service based on a fundamental analysis approach. It also has technical analysis tools for trading stocks, like Trading View charts.

Zacks puts a greater emphasis on earnings estimates and their upward or downward revisions. Zacks believes that stocks that exhibit increasing earnings estimates have a higher chance of outperforming the market.

Its free services include market data and information about the stock market and related market and financial news. The platform includes average price targets, brokerage recommendations, earnings, and dividends.

The Zacks Premium service includes the Zacks #1 Rank List, a portfolio of long-term stocks, a premium stock screener, equity research reports, and more.

The popular Zacks Rank feature provides a score to each stock based on value, growth, and momentum. The Zacks Ranks range from 1 to 5 mirroring strong buy to strong sell. Stocks with higher ranks are expected to outperform the markets.

For long-term investors, Zacks offers the Zacks Investor Collection. It includes real-time buy and sell signals and reports for stocks, ETFs, and mutual funds, on top of premium access.

Its Stock Screener allows investors to choose stocks matching their investing criteria. This includes price changes, dividends, EPS estimates, Zack Rank, and others. However, most of the filters are locked and available to premium subscribers only.

Visually, Zacks has a more traditional platform, data, and layout. Based on reviews, not all Zacks Rank #1 stocks have posted positive returns.

Which is the most trusted stock research website?

The 5 top investment research websites have a range of innovative tools that offer valuable insights. They all help investors make important decisions about which stocks to invest in. However, which do investors trust? We also thought it was important to see what their customers think.

When considering the services offered, costs, and what their customers think, TipRanks appears to be the preferred investment research website. It has a competitive edge as it offers alternative datasets that are otherwise available only to institutional investors. It also wins with its user-friendly and interactive interface. TipRanks has an attractive price compared to the other platforms available in the market.

Essentially, TipRanks is also the platform that customers like best according to their reviews. We used the well-known review tool Trustpilot to see how the websites rank and what their reviews tell us. They agreed with our assessment.

According to Trustpilot:

1. TipRanks tops the list with a score of 4.5 with an Excellent rating based on 195 reviews.

2. Second, on the list is Motley Fool with a score of 3.6 (106 reviews)

3. Third, on the list is Yahoo! Finance with a score of 3.2.

4. TradingView comes in fourth, with a score of 2.6 (468 reviews).

5. Last on the list is Zacks Investment Research with a score of 2.2 based on 52 reviews.