Archer Aviation (ACHR) is flying high, not just in the skies. The electric air taxi startup just landed its most significant win yet: it’s been named the Official Air Taxi Provider for the LA28 Olympic and Paralympic Games. This comes on the heels of major milestones like its FAA certification progress, a $142 million contract with the U.S. Air Force, and growing partnerships with United Airlines (UAL) and automaker Stellantis (STLA). Now, with the Olympics deal, Archer is cementing its status as a serious player in the future of urban air mobility.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A Big Platform to Build on

For Archer, this is more than just a flashy gig. It’s a golden opportunity to prove its tech works at scale in a busy, high-pressure environment. LA traffic is already a nightmare, and it could turn chaotic during the Olympics. If Archer can move people quickly and quietly through the skies, it could win over regulators, investors, and future customers in one shot.

The deal also helps Archer build out real infrastructure. The company plans to install “vertiports” (think helipads for air taxis) at key Olympic venues and tourist hubs like LAX, Santa Monica, and Hollywood. That network could live on long after the games, making Archer a key player in LA’s future transport system.

And don’t forget the exposure. With billions expected to tune into the Games, and Archer getting coverage through NBCUniversal, the brand is about to go global.

The bottom line: Archer isn’t just flying passengers; it’s flying into the spotlight. The LA28 deal could be a turning point for investors, showing that Archer isn’t a speculative venture anymore; it’s ready for primetime.

Is Archer Aviation Stock a Good Buy?

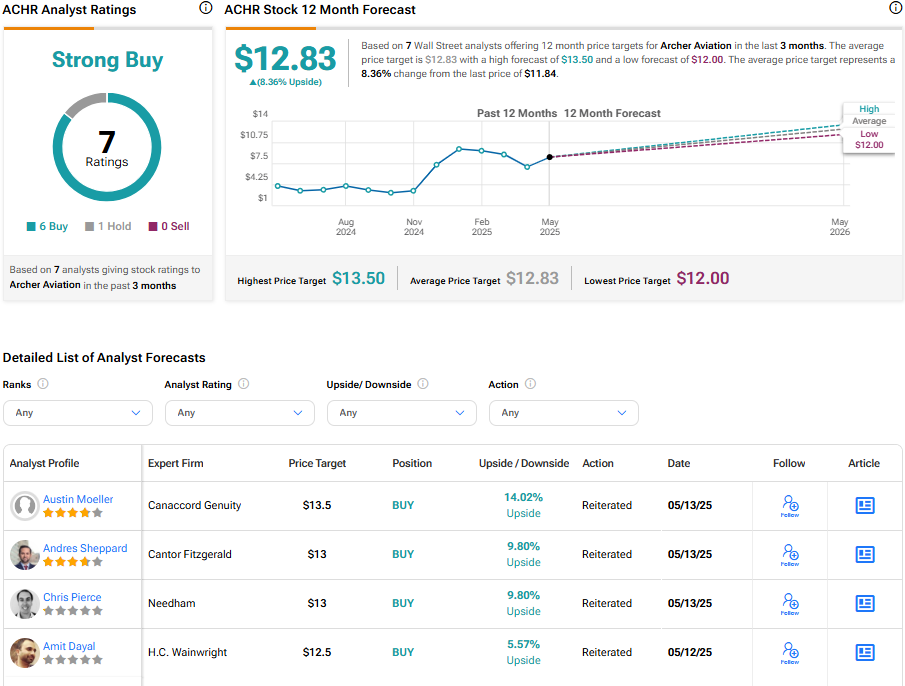

Wall Street analysts think so, giving it a Strong Buy rating. The average ACHR stock price target is $12.83, implying an 8.36% upside.