Shares of food and drug retailer Kroger (NYSE:KR) are trending marginally lower today despite the company’s better-than-anticipated Q3 results. Revenue of $33.96 billion exceeded expectations by $60 million, while EPS of $0.95 outpaced estimates by $0.04. However, the firm’s identical sales numbers disappointed.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

During the quarter, identical sales without fuel decreased by 0.6% compared to a 6.9% rise in the year-ago period. Furthermore, selling, general, and administrative expenses increased by 32 basis points due to higher investments in growth initiatives and the impact of the terminated agreement with Express Scripts.

Looking ahead to Fiscal Year 2023, the company expects identical sales without fuel to increase by 0.6% to 1%. In addition, EPS is anticipated to hover between $4.50 and $4.60, while adjusted free cash flow is projected to land between $2.5 billion and $2.7 billion.

What is the Target Price for KR?

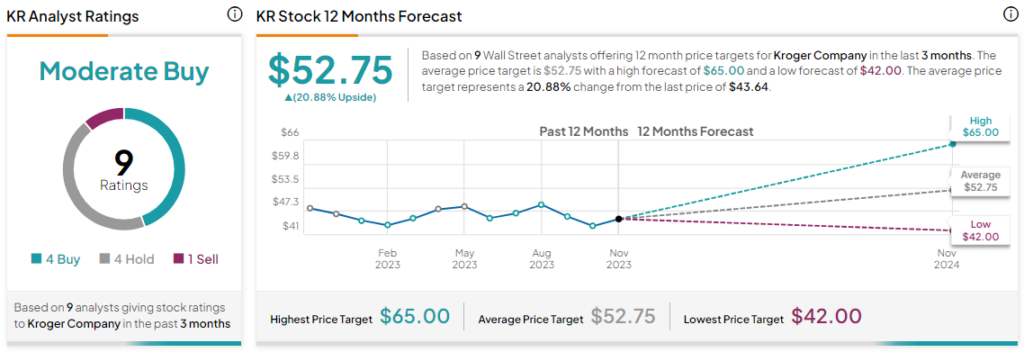

Overall, the Street has a Moderate Buy consensus rating on Kroger. Following a nearly 12% decline in the company’s share price over the past year, the average KR price target of $52.75 implies a 20.9% potential upside in the stock.

Read full Disclosure