Krispy Kreme (NASDAQ:DNUT) is a brand loved around the world. Unless you prefer cake donuts, then somewhat less so. However, the word out of Krispy Kreme’s long-term planning wasn’t well-received at all. The company was down over 8.5% in Thursday trading, and after-hours trading was somewhat more subdued.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The biggest problem for Krispy Kreme today was its long-term planning. On the surface, it looked positive enough. The company looked for an organic 10% gain in revenue for the year, with 2026 expected to produce $2.15 billion against this year’s total of $1.52 billion. U.S. sales are expected to grow nicely as well, going from $1.01 billion this year to $1.45 billion in 2026. Adjusted EBITDA figures will nearly double over this year’s $109 million, reaching $208 million in 2026.

The company also outlined its plans going forward. The company wants to focus on limited-time offers as well as stepping up its online shopping opportunities. Further, Krispy Kreme wants to put more focus on a “hub-and-spoke” model. Popularized by Disney (NYSE:DIS) theme parks, it basically has a market branching out from a central hub. In Krispy Kreme’s case, it looks to use that model to improve production efficiency and sales accordingly.

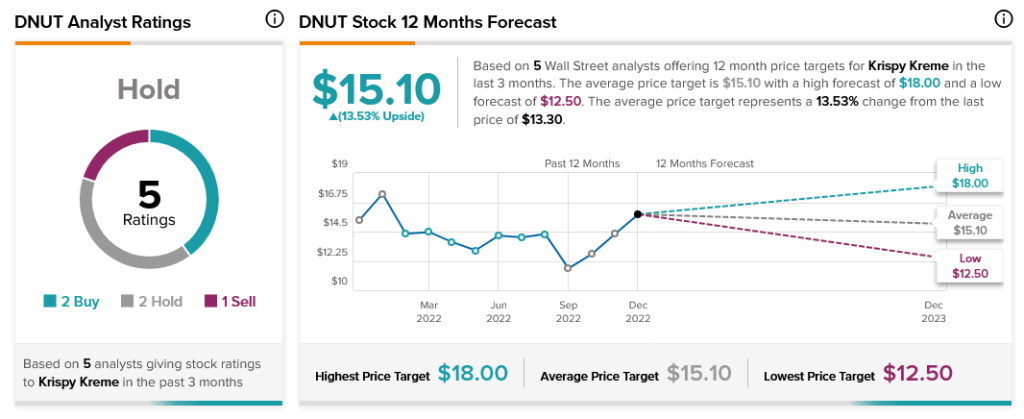

With Krispy Kreme down nearly 30% against this time last year, it’s clear the company needs to do something to get life back in it. Investors and analysts alike are unhappy with the performance so far. Analyst consensus currently considers Krispy Kreme a Hold, with as many Buy recommendations as Hold. Thanks to Krispy Kreme’s average price target of $15.10, the company has an upside potential of 13.53%.