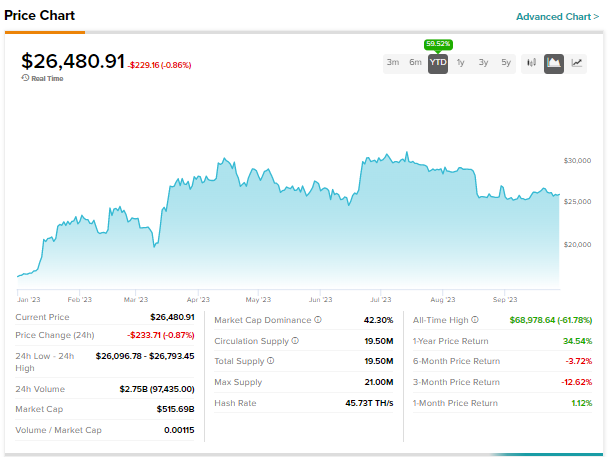

U.S.-based crypto exchange Kraken plans to offer stock and exchange traded funds (ETF) trading next year, Bloomberg reported. The firm is looking to grow beyond crypto at a time when the crypto market is facing increased regulatory scrutiny, with Bitcoin (BTC-USD) trading more than 60% below the nearly 69,000 level seen almost two years back.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Year-to-date, Bitcoin has risen about 60%.

Kraken to Offer Stock Trading

The crypto exchange aims to initially offer trading in the U.S. and U.K. markets through a service developed by its new division called Kraken Securities. Reportedly, it has already secured regulatory permits in the U.K. Further, it has applied for a broker-dealer license with the Financial Industry Regulatory Authority (FINRA) in the U.S.

Meanwhile, Kraken is working on its prime brokerage services and is set to launch a qualified custodian for institutional clients in the weeks ahead.

Kraken’s potential foray into equities will place it against players like Robinhood Markets (NASDAQ:HOOD) and Public.com. It is interesting to note that Public.com entered the U.K. market in July. Also, Robinhood announced in July that it plans to launch brokerage services to individual retail investors in the U.K. later this year as part of its strategy to expand its global footprint. Both these companies offer crypto as well as stock trading services.

Despite decline in crypto trading volumes this year, Kraken has experienced market share gains, as market leader Binance (BNB-USD) is facing a regulatory crackdown.

When asked about the news of its entry into stock trading, the company declined to comment on any rumors or speculation but said that it seeks to broaden and enhance its offerings.

Earlier this week, the company announced that it has been granted an E-Money Institution (EMI) authorization in Ireland. The EMI license will enable the company to expand Euro-to-crypto trading services to 27 European Union member states and European Economic Area countries. It recently gained a virtual asset service provider (VASP) registration in Spain to provide crypto exchange and custodial wallet services.

Previously, the company secured VASP registrations in Ireland and Italy. These recent developments are in line with Kraken’s strategy to expand its crypto business in Europe, as regulatory pressure mounts in the domestic market.