Department store retail chain Kohl’s Corp. (NYSE: KSS) has unveiled the locations of the 400 Sephora at Kohl’s stores that it plans to open this year. These 400 stores, which will be spread across 36 U.S. states, will take the total number of Sephora at Kohl’s locations to 600.

Further, of these 400 stores, eight will be new Sephora at Kohl’s locations. Kohl’s and Sephora plan to open 850 Sephora at Kohl’s stores by next year.

Doug Howe, the Chief Merchandising Officer at Kohl’s, said, “The quick and vast rollout of Sephora at Kohl’s is a testament to how much we believe in this partnership and making prestige beauty more accessible to people everywhere.”

Additionally, starting spring, Sephora at Kohl’s will offer six new prestige beauty brands — Murad, Clarins, Jack Black, Living Proof, Versace and Voluspa.

Sephora at Kohl’s brand portfolio already includes Rare Beauty, NARS, Charlotte Tilbury, Kiehl’s, Giorgio Armani, Olaplex, Clinique and Sephora Collection, among others.

Sephora’s Executive Vice-President and Global Chief Merchandising Officer, Artemis Patrick, said, “The additions of these new brands to Sephora at Kohl’s demonstrate how we are continuing to bolster the assortment to bring the best experience to all of our new and existing customers.”

About Kohl’s

Based out of Wisconsin, omnichannel retailer Kohl’s runs 1,100 stores in 49 states across the U.S. It also operates Kohls.com website and the Kohl’s App. The company’s offerings include apparel, shoes, accessories, and home & beauty products.

Following the announcement, KSS stock gained 2.8% on Tuesday to close at $59.72.

Analysts’ Take

Recently, Gordon Haskett Capital Corporation analyst Chuck Grom reiterated a Buy rating on the stock and lowered the price target from $85 to $70 (17.2% upside potential).

Last month, Paul Lejuez of Citigroup (NYSE: C) also reduced the price target for Kohl’s to $69 (15.5% upside potential) from $73 and retained a Buy rating.

Overall, the stock has a Moderate Buy consensus rating based on 7 Buys, 4 Holds and 3 Sells. The average KSS price target of $65.50 implies 9.7% upside potential. Shares have gained 39.5% over the past year.

Website Traffic

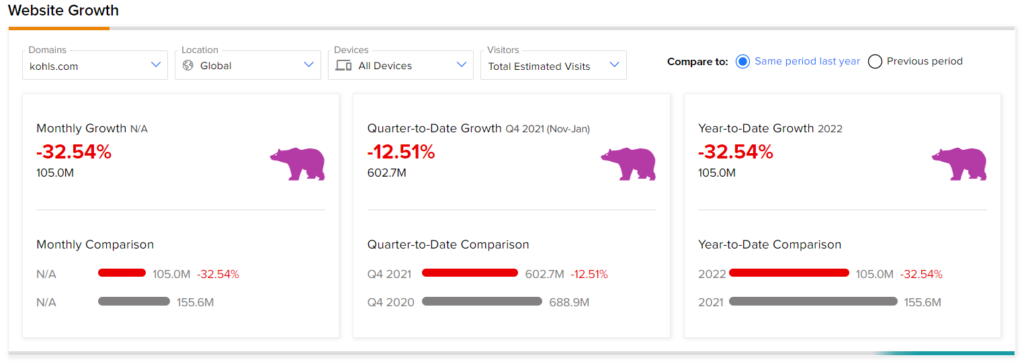

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (NYSE: SEMR), the world’s biggest website usage monitoring service, offers insight into Kohl’s performance.

According to the tool, compared to the previous year, Kohl’s website traffic has registered a 32.5% decline in global visits year-to-date.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

GM Extends Production Halt of Bolt Until April — Report

ContextLogic Introduces ‘Wish Clips’ Feature; Shares Jump Over 18%

Trade Desk Unveils OpenPath to Rival Google; Shares Jump 5%