Activist investor Macellum Advisors GP LLC is again targeting department store chain Kohl’s (NYSE:KSS), asking the company to replace three or more long-term directors, including chairman Peter Boneparth.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Citing people familiar with the matter, the Wall Street Journal (WSJ) stated that Macellum, which has about a 5% stake in Kohl’s, has warned the company of another proxy fight if the board changes are not made.

Activist Pressure Builds on Kohl’s

Macellum feels that Kohl’s long-serving members lack retail experience. In an open letter addressed to Kohl’s shareholders, which was viewed by WSJ, Macellum CEO Jonathan Duskin blamed Kohl’s chairman for being “a root cause of the board’s poor oversight and insular thinking.”

Macellum’s move comes after Kohl’s terminated the plan to sell its business to the Franchise Group (FRG), the owner of The Vitamin Shoppe, in July. Last month, activist investor Ancora Holdings also called for the removal of Kohl’s CEO Michelle Gass and chairman Boneparth.

Back in April 2021, Macellum, Ancora, and other activist investors reached a settlement with Kohl’s, pursuant to which the company agreed to add three independent directors to the board, including Tom Kingsbury, the former CEO of Burlington Stores (BURL). However, activist investors again started putting pressure within one year of the settlement, demanding a board shake-up and other changes.

Even prior to the pandemic, Kohl’s and other department store peers, like Macy’s (M), were struggling to thrive due to growing competition from e-commerce retailers as well as off-price players. The ongoing macro challenges have made matters worse for the company.

As per WSJ, Kohl’s expressed its disappointment with Macellum’s demands and called its discussion with the activist investor “unproductive and a distraction” amid a challenging retail backdrop.

Is Kohl’s a Buy or Sell?

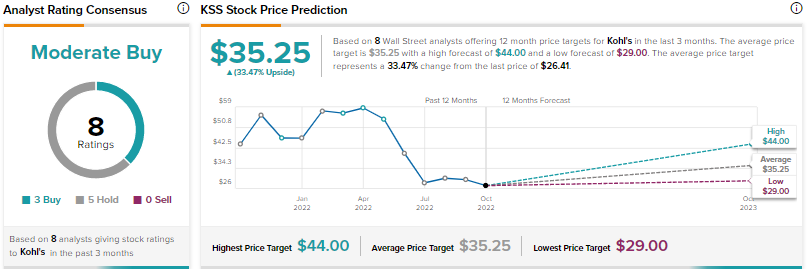

Wall Street is cautiously optimistic about Kohl’s stock, with a Moderate Buy consensus rating based on three Buys and five Holds. The average KSS stock price target of $35.25 implies 33.5% upside potential from current levels. Shares have plunged nearly 47% year-to-date.