Shares of omnichannel retailer Kohl’s Corp. (NYSE:KSS) are under pressure today after the company disclosed the departure of its President and Chief Operating Officer (COO), Dave Alves, in a regulatory filing.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

However, Kohl’s did not disclose the reason for Alves’ departure or who his successor will be. The development comes after Kohl’s announced a transition plan for its Board earlier this month.

Kohl’s long-time director, Peter Boneparth, plans to retire as Board Chair in May 2024. The company’s Board has appointed Michael Bender as its Chair following the retirement of Boneparth.

The departure of Kohl’s COO comes even as the company is slated to announce its third-quarter results on November 21. Analysts expect Kohl’s to generate an EPS of $0.35 on revenue of $3.99 billion for the quarter. In the comparable year-ago period, KSS’ EPS of $0.82 had comfortably outpaced expectations by $0.05.

Is KSS a Good Investment?

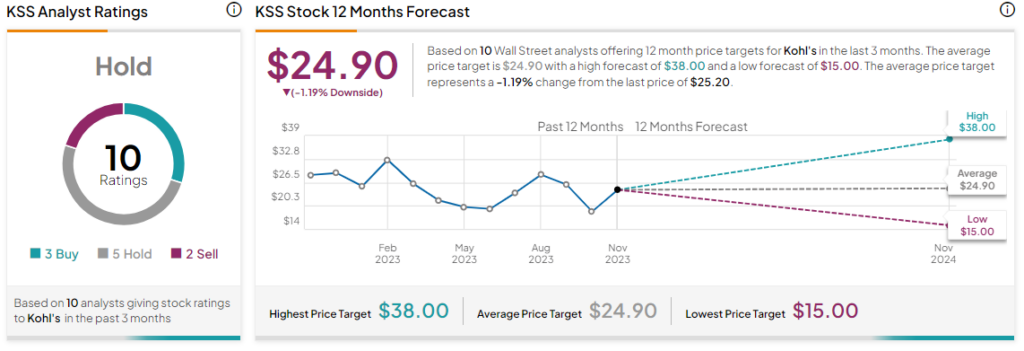

Overall, the Street has a Hold consensus rating on Kohl’s, and the average KSS price target of $24.90 implies 1.2% potential downside in the stock. That’s on top of a nearly 18.6% slide in the company’s share price over the past year.

Read full Disclosure