Department store retailer Kohl’s Corp. (NYSE:KSS) fell in pre-market trading after the company posted Q3 net sales of $3.8 billion. This was a decline of 5.2% year-over-year, which fell short of consensus estimates of $3.99 billion.

Furthermore, the retailer reported earnings of $0.53 per share in the third quarter compared to $0.82 per share in the same period last year. However, this surpassed analysts’ estimates of $0.35 per share.

Looking forward to FY23, Kohl’s expects its net sales to decline by 2.8% to 4%. This includes the “impact of the 53rd week, which is worth approximately 1% year-over-year.” Nevertheless, the company raised its FY23 outlook and now forecasts diluted earnings to land between $2.30 and $2.70 per share. For reference, the prior guidance was between $2.10 and $2.70 per share.

Moreover, Kohl’s Board of Directors declared a quarterly cash dividend of $0.50 per share, payable on December 20 to shareholders of record on December 6.

Is KSS Stock a Good Buy?

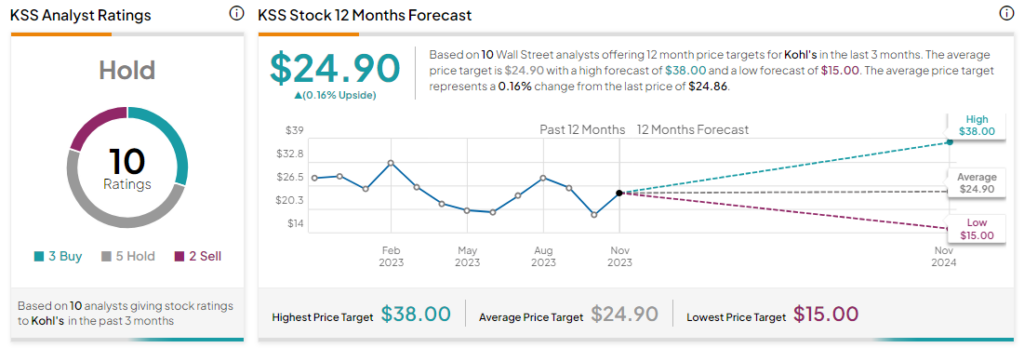

Analysts remain sidelined about KSS stock with a Hold consensus rating based on three Buys, five Holds, and two Sells. Even as KSS stock has slid by more than 10% in the past year, the average KSS price target of $24.90 implies that the stock is currently fairly valued.