CarMax (NYSE:KMX) shares plummeted by nearly 14% in today’s early session following the automotive retailer’s fourth-quarter results falling short of expectations.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Sales Disappoint

KMX’s Q4 top line contracted by 1.7% year-over-year to $5.63 billion. The figure missed consensus by $150 million. Similarly, its EPS of $0.32 missed estimates by $0.14. While retail used unit sales improved by 1.3%, its wholesale unit sales declined by 4%. On a combined basis, the company’s used vehicle unit sales declined by 0.9% to 287,603.

The downturn comes amid low consumer confidence, inflationary pressures, and high interest rates. Throughout the quarter, CarMax sold retail units at prices 2.3% lower and wholesale units at prices 3.2% lower. These dynamics led to a 4.1% decrease in the company’s gross profit, totaling $586.2 million in Q4.

Cautious Guidance

For Fiscal year 2025, CarMax anticipates that capital expenditures will be in the $500 million to $550 million range. Over a longer timeframe, KMX aims to sell more than 2 million units annually.

However, the company is now planning to extend the timeframe to reach this goal, which could now span from FY 2026 to FY 2030.

What Is the Price Prediction for KMX?

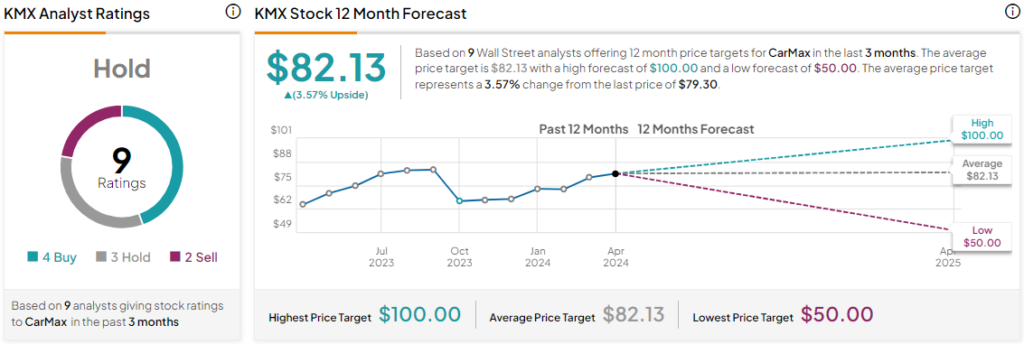

Today’s price decline comes after a nearly 15% rise in KMX’s share price over the past six months. Overall, the Street has a Hold consensus rating on CarMax, alongside an average KMX price target of $82.13. However, analysts’ views on the stock could see a revision following today’s earnings report.

Read full Disclosure